Fashion Fresh Cleaners - Crossroads Shopping Center, Vineyards, Fl

Long controlled past retail conglomerates, the beauty industry has turned online.

Once "challenger" brands like IPSY, Glossier, and Fenty are now household names — spanning geographies and demographics alike.

Entrepreneurs rush to greet a new wave of consumers seeking fresh norms and niche products. Clinging to enterprise status, CPG manufactures reply by either acquiring their contained counterparts, partnering with them, or launching private-label alternatives.

Did COVID-19 negatively affect sales? Yes. Does brick-and-mortar still boss? Also, yes. But …

Is the beauty industry growing? Especially ecommerce cosmetics in 2021, 2022, and across? Absolutely.

Statistics, trends, and strategies guide the way forward. That's exactly what this exhaustive report volition embrace:

- Statistics: Beauty Manufacture Market Share & Growth in 2021

- Trends: Insight from 2022'due south Peak Cosmetics Brands & Companies

- Strategies: Your Ecommerce Marketing Growth Programme 'Make Over'

Don't miss that concluding department …

In that location you lot'll discover detailed examples, packed with tactics and lessons, from three fast-growing directly-to-consumer (DTC) companies.

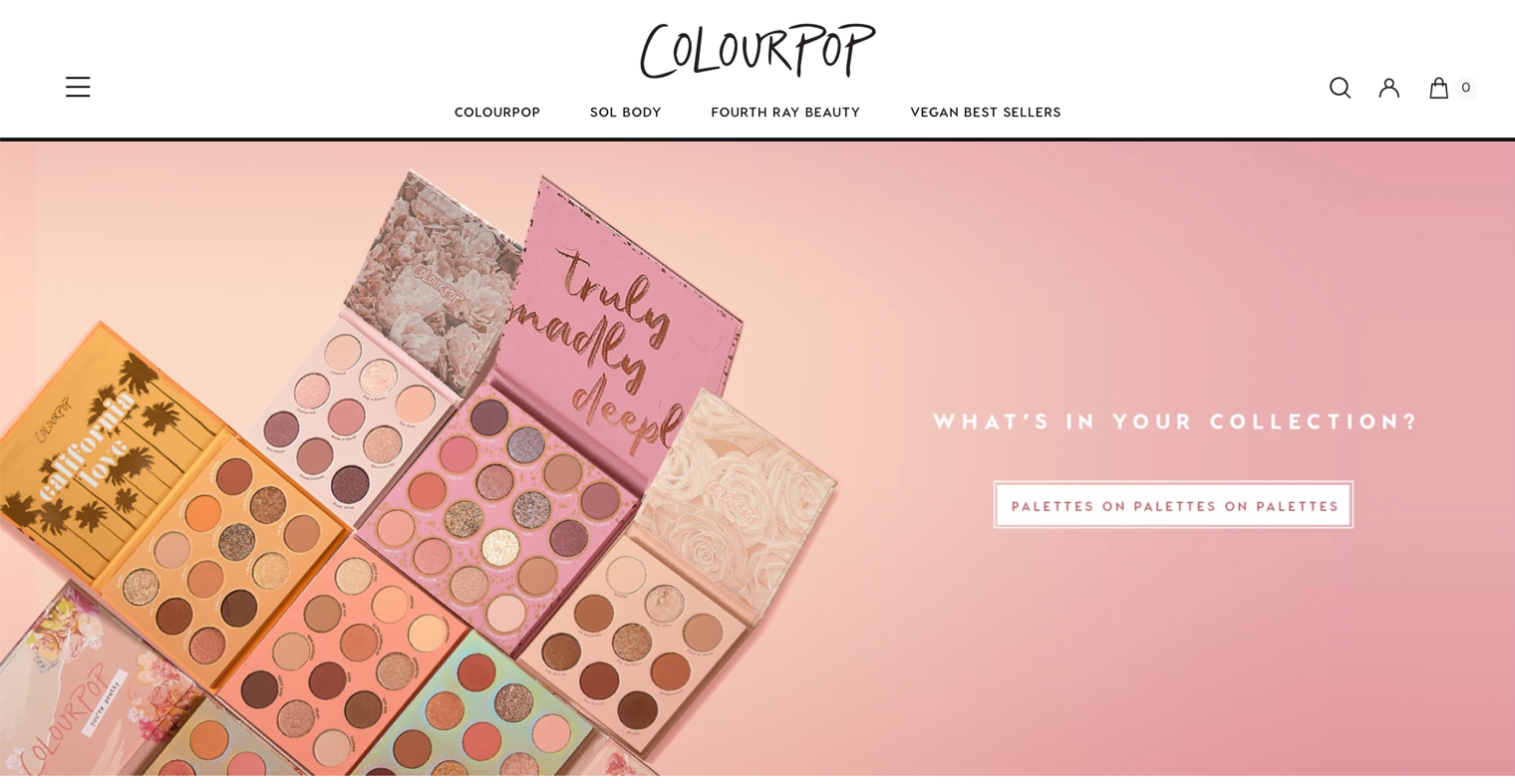

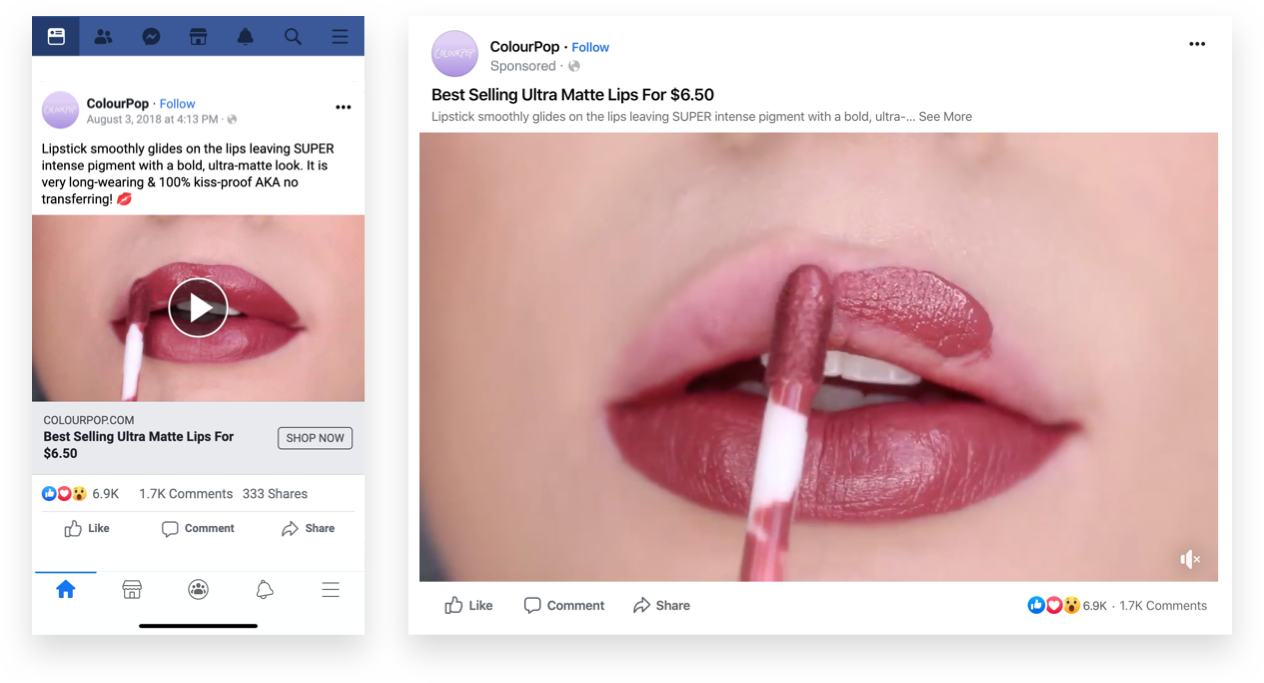

ColourPop

In a competitive market, this indie brand stood out against expensive rivals with creative that highlighted product quality. The payoff?

5x return on prospecting campaigns, 7.5x return on remarketing efforts, and 15x return on its social campaigns made in collaboration with Disney.

Coola

Every bit a brand that wasn't digitally native, the eco-conscious retailer's hurdle was gaining traffic online. By selling through product funnels using Facebook advertising, it offered customers the niche products they actually needed.

Conversions increased, repeat customers lifted +l%, and the brand hitting 140% year-over-twelvemonth growth.

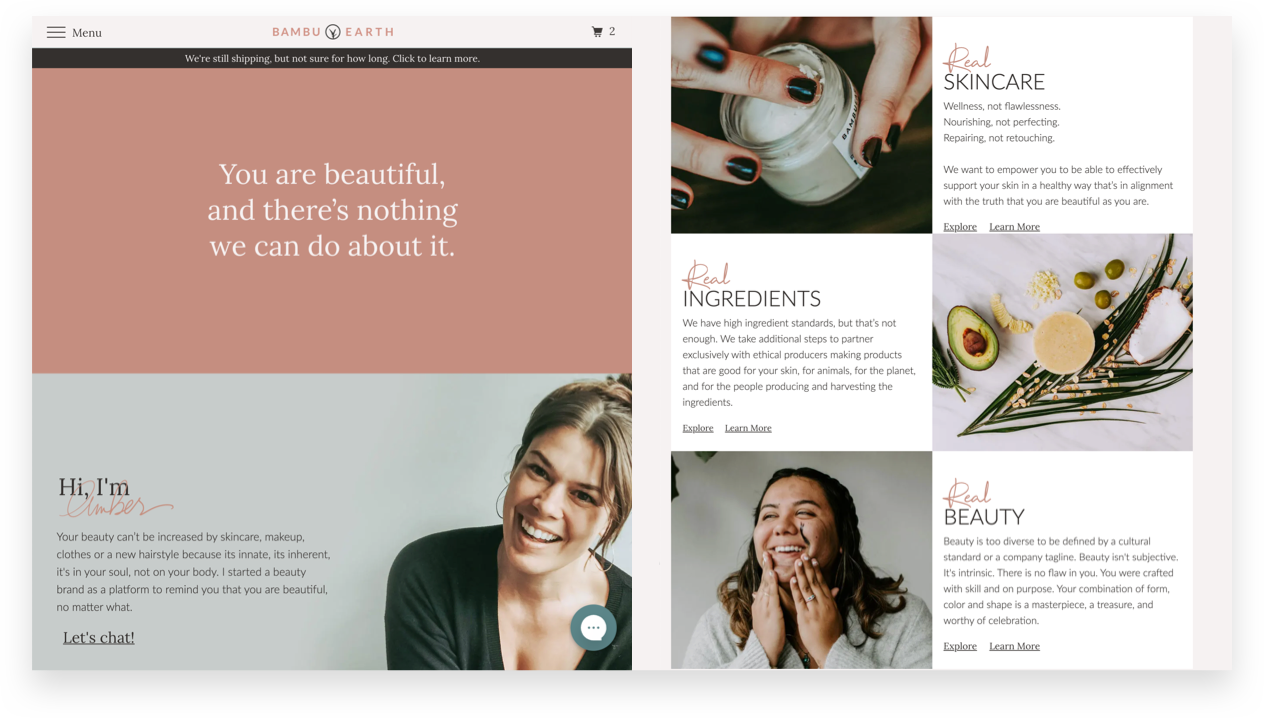

Bambu Earth

Struggling with low traffic and dismal conversion charge per unit that no new creative or improve-performing ad could fix — this clean-beauty brand needed a refresh. Its lifeline came in the form of an online "Skin Quiz," powerhouse UGC, and insights from customers seeded throughout the funnel.

The results? 25x revenue YoY, 2.5x AOV, and profitability for the starting time time.

Statistics: Dazzler Manufacture Market Share & Growth in 2021

For the purpose of this study, we'll split dazzler into three categories: skincare, colour cosmetics (make-upwards), and fragrance. Though closely related, we've separated health and wellness — i.eastward., personal care — into its own ecommerce guide.

Beauty Manufacture Statistics and Market Inquiry: Global & United states

Globally, the industry is strong and just getting stronger.

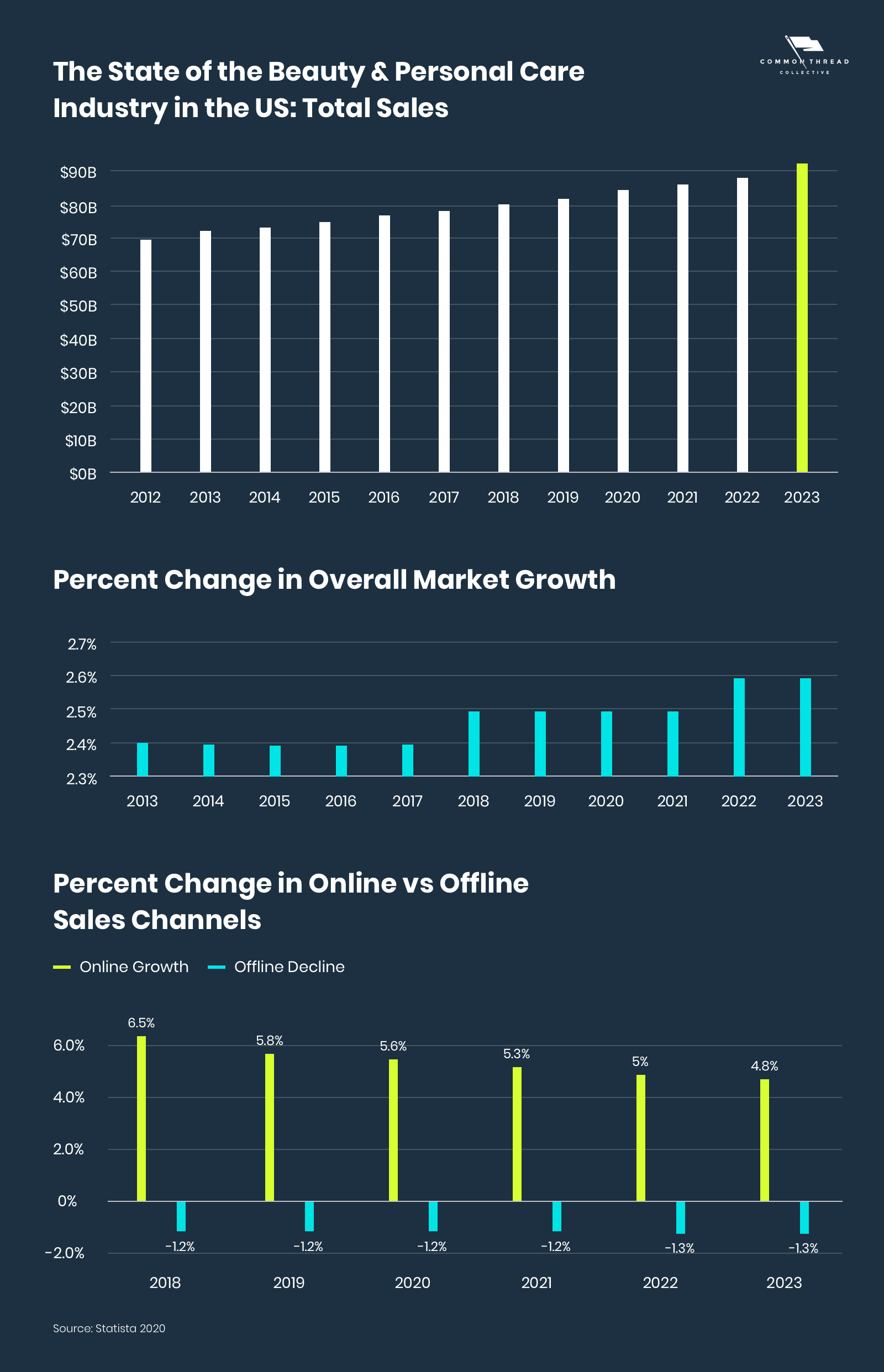

How big is the beauty industry? Up from $483B in 2020 to $511B in 2021 — and with an annual compounded growth rate of four.75% worldwide — it's predicted to exceed $716B by 2025. And $784.6B by 2027.

The kindling? Rapid expansion through digital channels and the attraction of more than customers willing to pay higher prices for higher quality.

As emerging nations grow in purchasing power and become globalized, they offer budding hope for international companies to enter — if they bring higher quality products than those available locally along with them.

Past geography, Asia Pacific and North America dominated; bookkeeping for more than 60% of the total.

With shopping preferences differing from county-to-state, brands looking to rule on a global calibration must follow a client-centric model that intersects both digital and physical channels.

Much like the experiential home furnishings industry, offline shopping still rules — luring a whopping 81% of buyers. At the same time, offline's share is declining while online climbs.

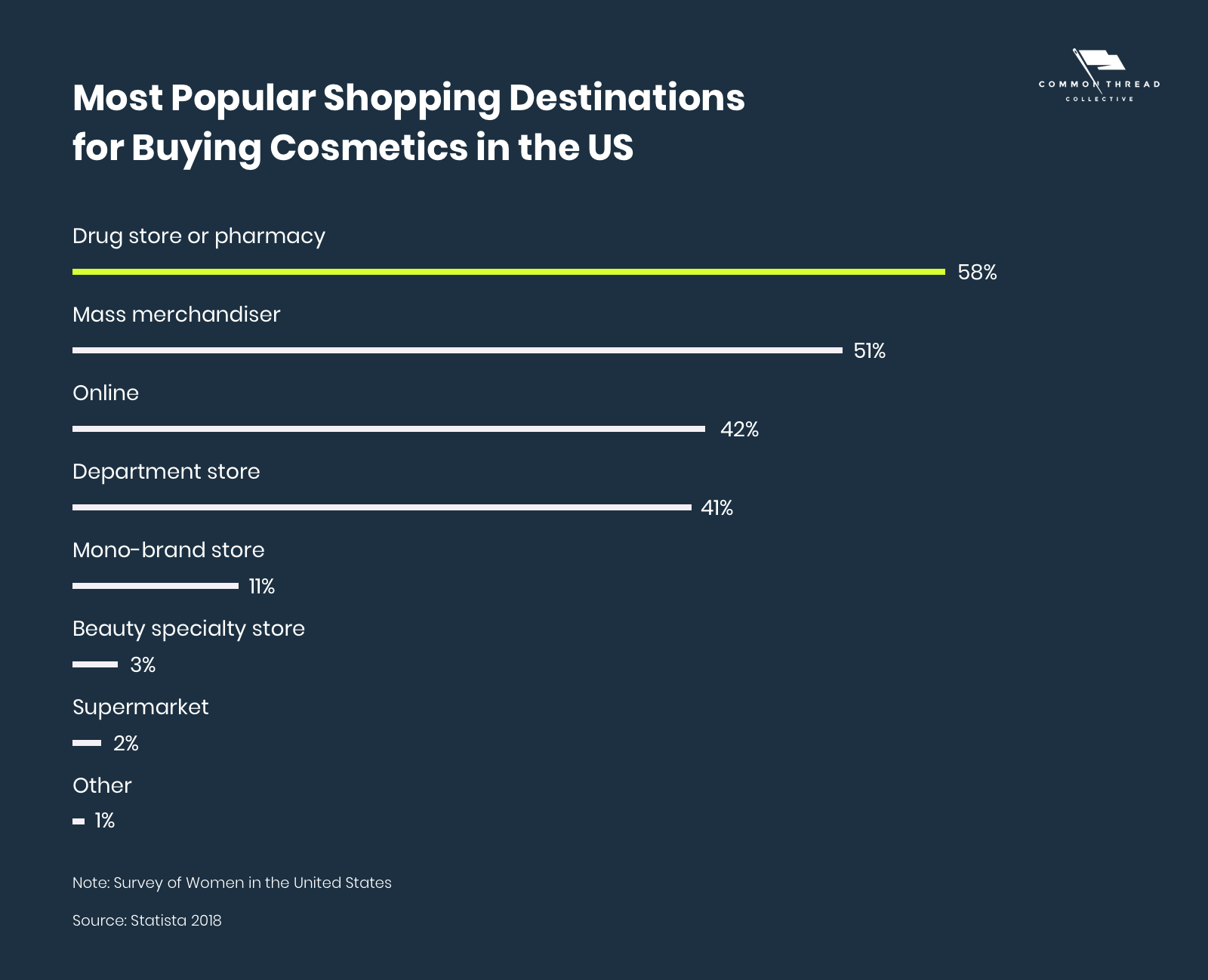

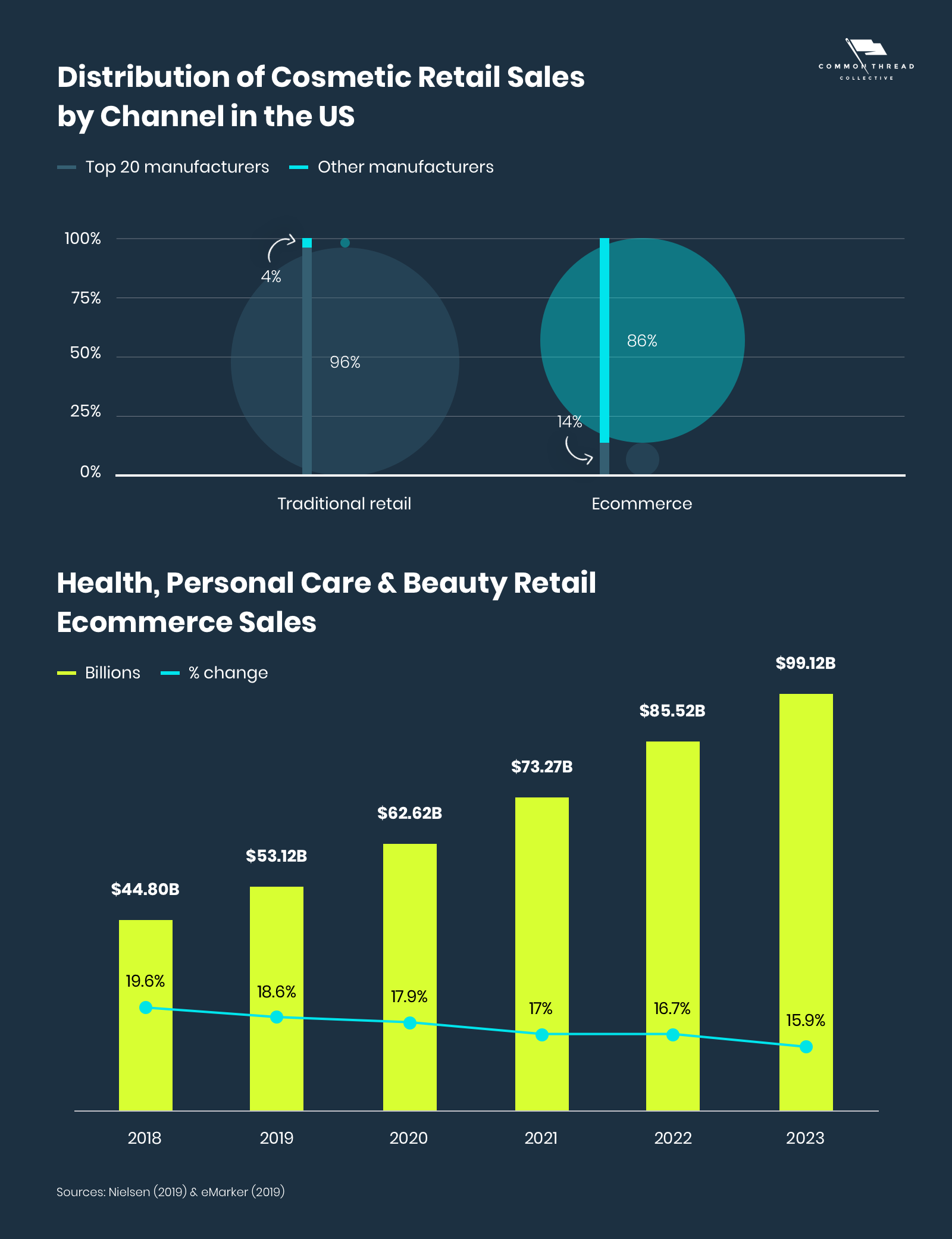

Though the distribution methods are evolving, traditional chains however play the largest role in the US. For anyone following ecommerce's trending growth, that shift is hardly a surprise.

Bated from superstores like Walmart and Target, the biggest vertical-specific players are Ulta and Sephora.

The aforementioned holds true on a worldwide scale.

For more than a century, product has been controlled past a handful of multinational conglomerates. The long-reigning legacies — L'Oréal, Unilever, Procter & Gamble, and Estée Lauder Companies — made up a whopping 81.7% of worldwide revenue in 2019.

In the US, all hopes plow to ecommerce.

Although ecommerce penetration has just increased slightly in recent years, the online share is predicted to surge to 48% in the United States by 2023.

While promising, mass-merchandiser and multi-brand platforms currently take a stranglehold on the marketplace.

Only, ecommerce offers something legacy dazzler retailers do non: exclusivity.

The way into the winner's club unites that desire for convenience with quality products. eMarketer reports that buyers who valued quality most were more likely to shop direct from a site (64%), while large-box stores won shoppers on cost (28%).

Tired of scrolling? Want to save the report for later or share with your squad? Good news: Yous can.

Nosotros've compiled all the information, tactics, and case studies into a single — and gorgeous — PDF. No strings fastened …

Trends: Insight from 2022's Pinnacle Cosmetics Brands & Companies

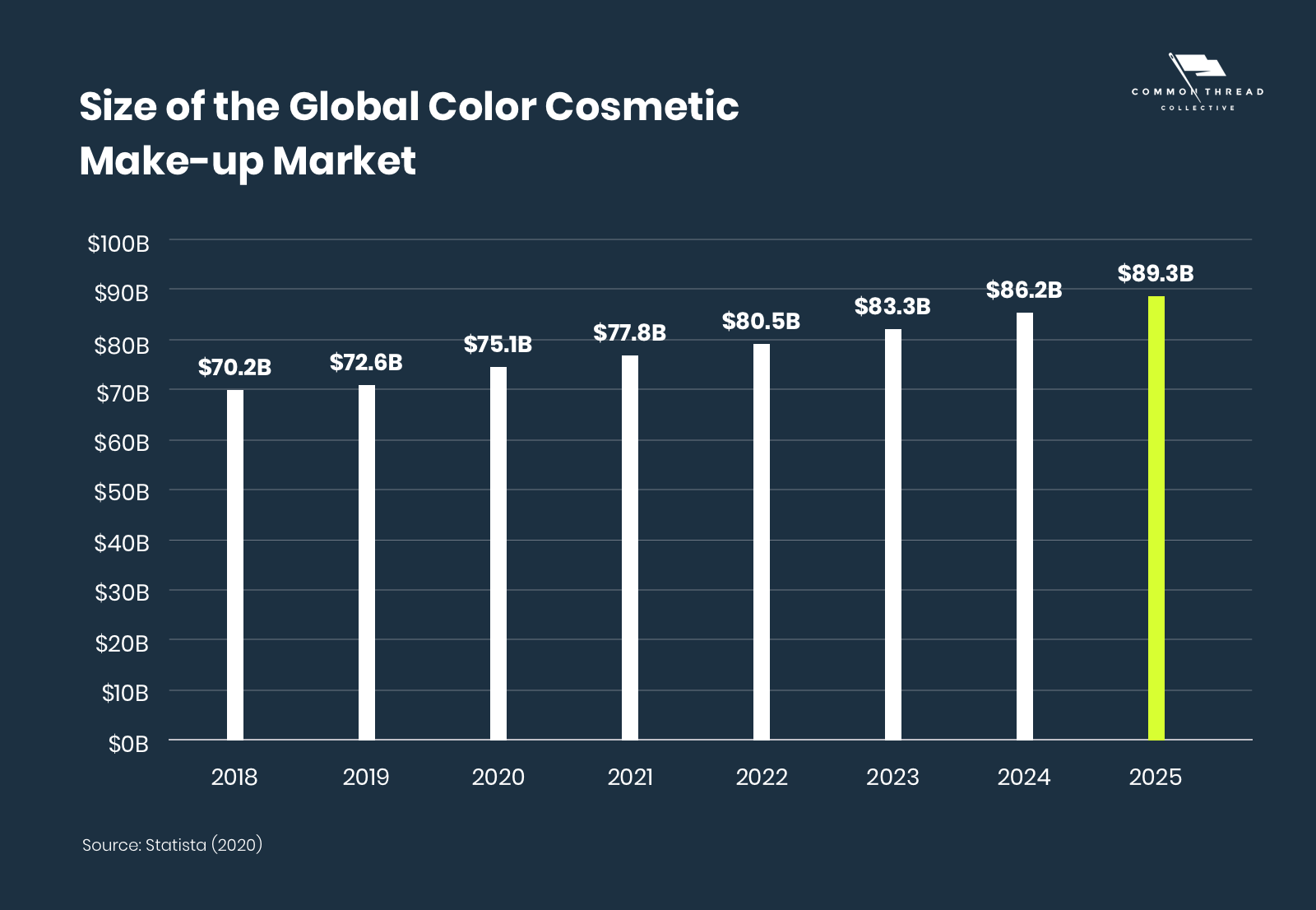

Each vertical tin exist differentiated further, both by distribution channel and make. Colour cosmetics occupy a unique segment as they're available in a wide range of locations — from luxury spas, salons, and department stores to home-television shopping, drugstores, and airdrome vending machines.

According to a survey from Pymnts, the nigh important factor influencing consumer beliefs — across price or location — were special sales, unique products, and rewards programs.

Much similar ecommerce manner and even the online pet manufacture, brands tin can lean into these digital marketing strategies with the exclusivity of the online shopping experience to challenge the upper-hand of in-shop retailers.

Beyond channels, there's another divisive trend — natural and sustainable products versus discount and mass produced.

Because of ascension incomes, consumers increasingly consider effectiveness and ingredients over price. Every bit a outcome, positioning at present focuses on demonstrating quality through customer reviews and UGC as well as sustainability through formulation.

To win in the fight over product superiority comes from the marketing use of three trivial words: natural, organic, or make clean.

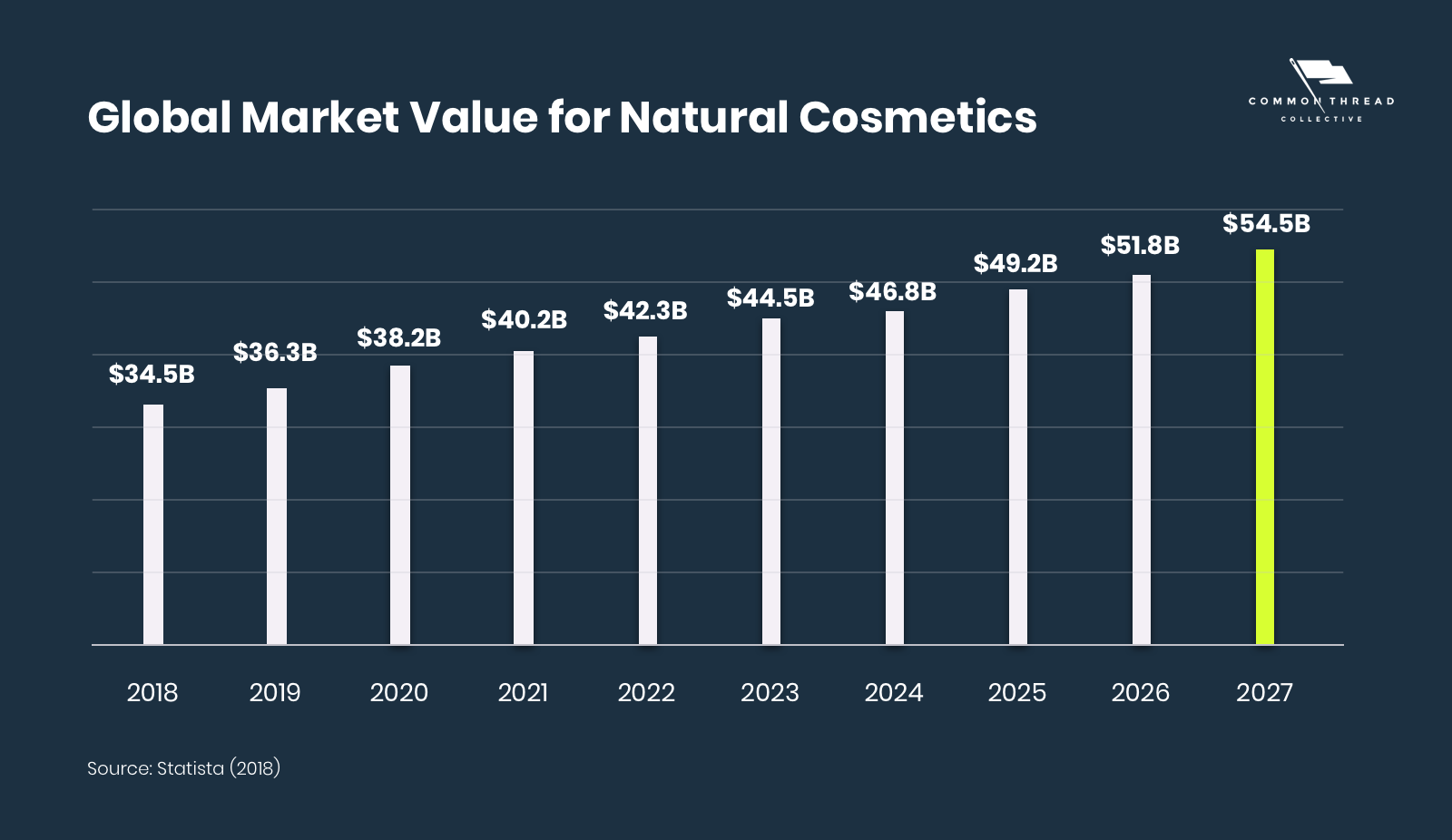

Simply, "clean dazzler" and "organic makeup" are more than than just buzzwords. The global value for natural cosmetics is expected to achieve $54.5 billion by 2027.

The division lies within the definition. To be considered natural, the product must meet non-toxic standards for ingredients and processing.

Since there isn't strict regulation, insecurity permeates over what actually constitutes "natural."

Upstarts that desire to boss the competitive arena should look to build an authentic and sustainable model.

As consumers get increasingly wary of potential toxicity, safe and fragrance-free products made using natural ingredients and essential oils are likely to record strong growth in the future.

Beauty Products past Market Share and Growth: Skin Care, Hair Care, Make-Up & Perfumes

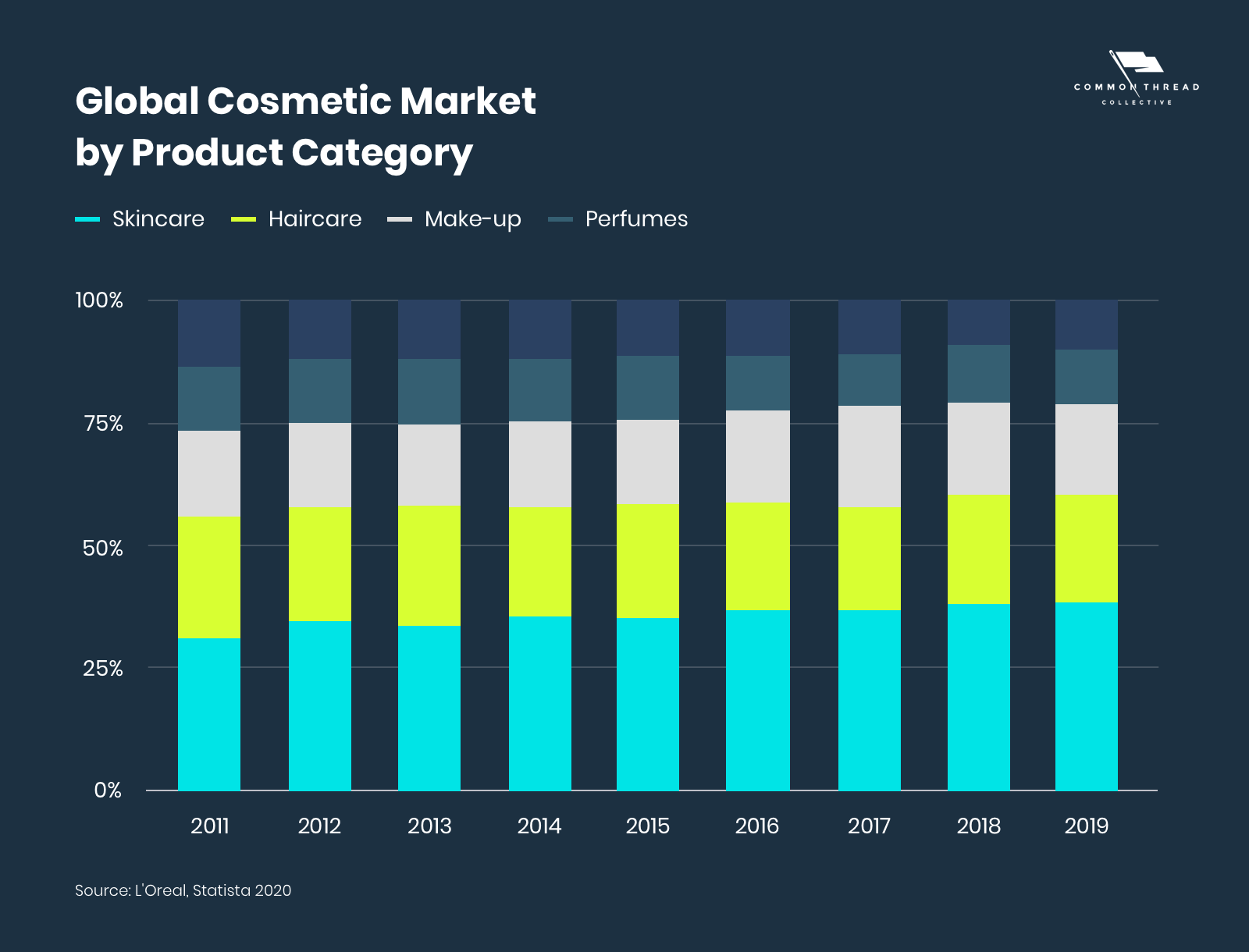

Beyond product categories, skincare made up 40% of the global cosmetic market in 2019.

It follows that this tendency will continue as consumers go more educated nearly sunday damage — indicating potential for growth inside the subcategories of sun protection and anti-crumbling skincare products.

In the same vein, brands that meet consumer's new demands and expectation levels of quality will experience growth.

Demographics & Client Experience

As not-western countries climb in purchasing power, their influence on demographics follow. With ethnicity, culture, and rituals different from Northward America and Europe, diversity shapes the world in its paradigm.

Diverseness is now the norm.

"It's non enough to make l shades of foundation and merely sell the dark ones online," said influencer Jackia Aina in an interview last year. "I've direct seen how the consumers have demanded better and fairer retail shopping experiences for everyone … we've seen a big rise in brands expanding on their products."

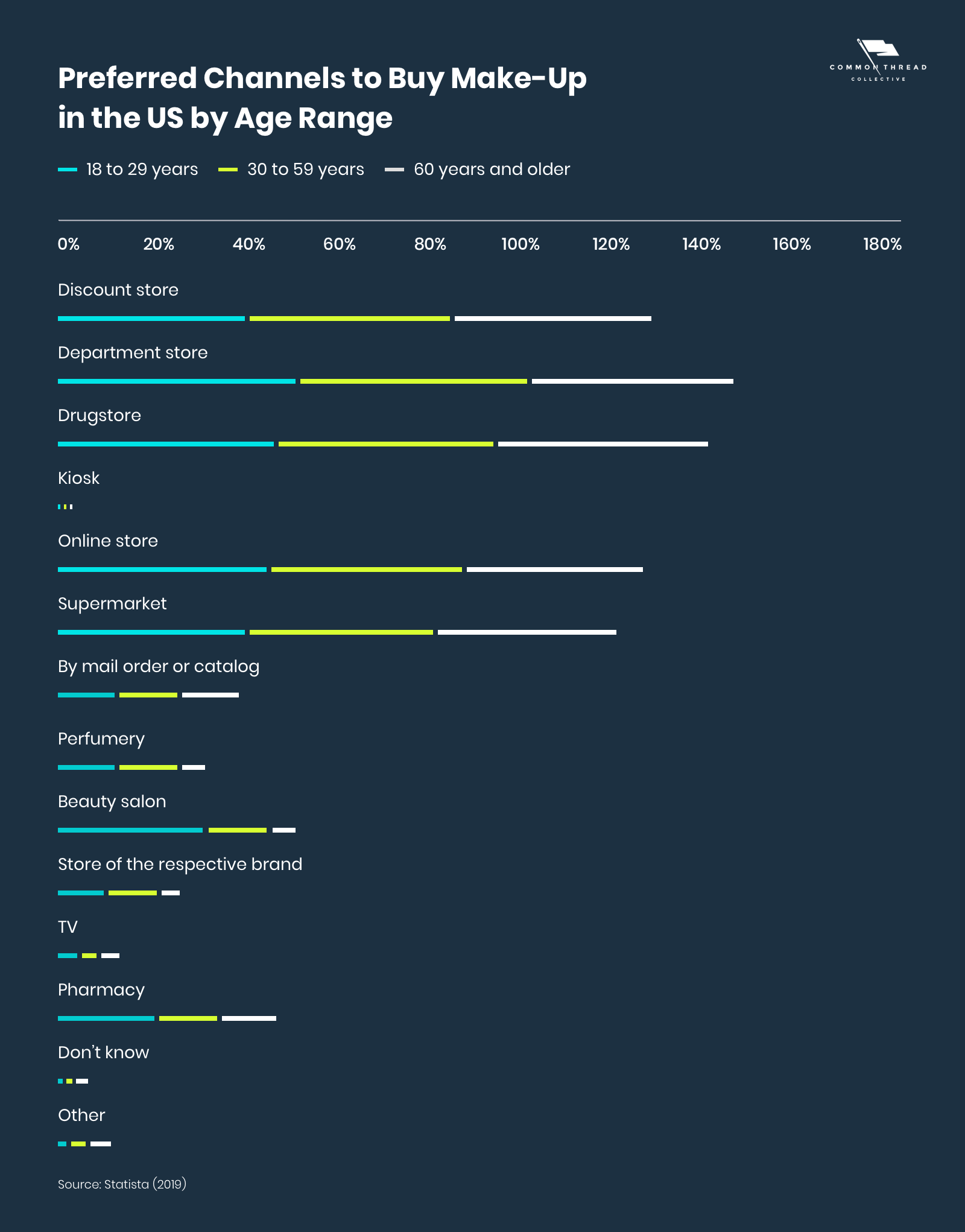

Ethnicity isn't the only driver, age plays a critical part in how consumers store for personal intendance products.

Every bit a upshot of entering the job marketplace, Millennials and Gen Z have become the biggest drivers of new business. This is especially glaring in the Usa, where they have above-boilerplate expenditures on personal care products — an alphabetize of 122 on cosmetic products — compared to other shoppers.

Of the leading brand-up purchase criteria co-ordinate to women in the US — the importance of quality, value, and the brand remained relatively similar across all age-groups.

Among Millennials, in particular, were meaning differences.

They more than than doubled their infant boomer counterparts in regard to preference for organic or eco-friendliness.

Even more hit, 29% of them brand purchasing decisions based on media or online reviews — 3x greater than that of Gen X'ers and a whopping 6x more than Baby Boomers.

This sets the stage for social proof equally the key to unlock Millennials' loyalty and trust. Socially and digitally native brands are in a prime position to capture that need.

Which, of course, brings us to …

Amazon & Walmart

Amazon's success in even so another CPG category is no surprise. According to Edison Trends data, health and dazzler is the third-virtually-purchased category — accounting for 44.3% of total online sales in the US.

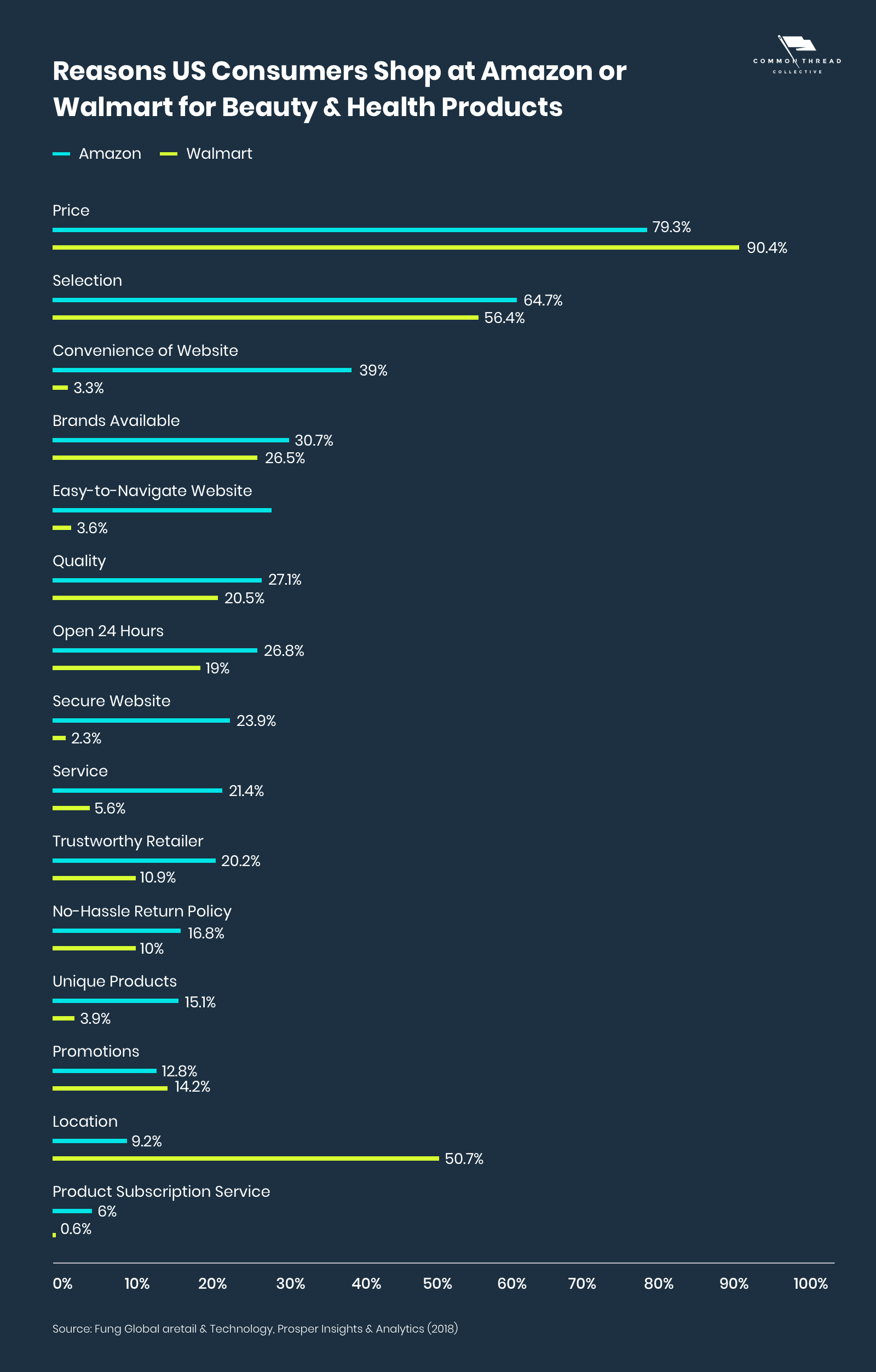

Consumers cite the convenience of Amazon's website, easy navigation, and service as the primary reasons they choose Amazon over Walmart.

This is likewise bolstered by its Prime membership program. According to eMarketer, 52.5% of Prime number members bought beauty products in the by 12 months vs. xvi.9% of nonmembers.

Although Amazon'southward growing, shoppers all the same adopt other channels. Ulta has far college ecommerce sales ($618.8 billion) and simply 10.1% comes from digital channels.

Information technology'southward a blink of hope for beauty retailers not selling on the platform, that Amazon isn't always the end-all-be-all.

2022's Top Dazzler Companies & Cosmetics Brands, Plus Five Trends

Legacy: Height 10

Leading for more than a century, legacy brands dominate on a global calibration.

Since 81% of all US consumers store in-stores, their longstanding product placements in brick-and-mortar and drugstore chains are specially lucrative.

Meet, the old guard:

And all the same, loyalty has waned. Call it karma — legacy retailers who preached youth equals cute are now being pushed out by younger make counterparts …

Direct-to-Consumer: Top 25

The old guard of makeup brands — like 50'Oréal, Estée Lauder, and Chanel — though revered for their revenue and legacy, aren't revered past all.

As a new generation of consumers grows upwards, they're more than empowered to purchase "quick-to-market" products found via social media from brands that are growing right alongside them.

Enter, the new guard courtesy of 2PM Inc.'due south DTC Power List:

- IPSY

- Fenty

- Morphe

- Kylie Cosmetics

- Glossier

- Curology

- Ouia

- Function of Dazzler

- Vanity Planet

- Drunk Elephant

- Tula

- MILK Makeup

- Prose Hair

- Supergoop!

- True Botanicals

- The Honest Company

- Frank Body

- Oui the People

- Kopari

- Topicals

- Goop

- Volition

- Blume

- Birchbox

- Alleyoop

The rise of social shopping coupled with more than consumer packaged goods offerings online, lends itself to new ecommerce penetration opportunities for DTC brands.

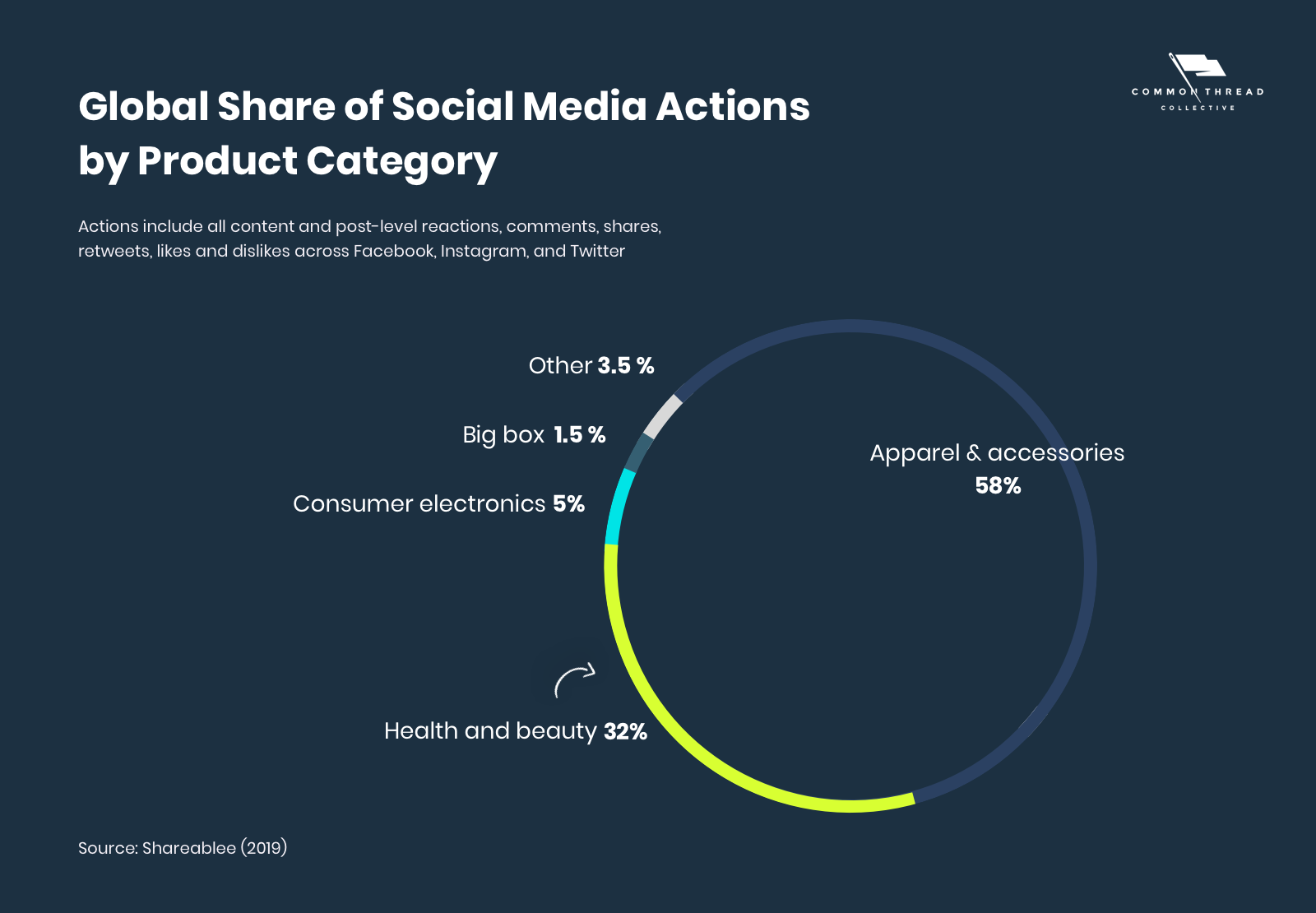

What'south more, beauty products brand up the 2d-largest production category for engagement across Instagram, Twitter, and Facebook.

"Information technology's not merely the billion-dollar brands like Kylie and Glossier," said Andrew Lipsman, eMarketer principal analyst. "There's a whole cottage industry of emerging directly-to-consumer brands that are leveraging targeted social ads and influencer marketing to accelerate growth."

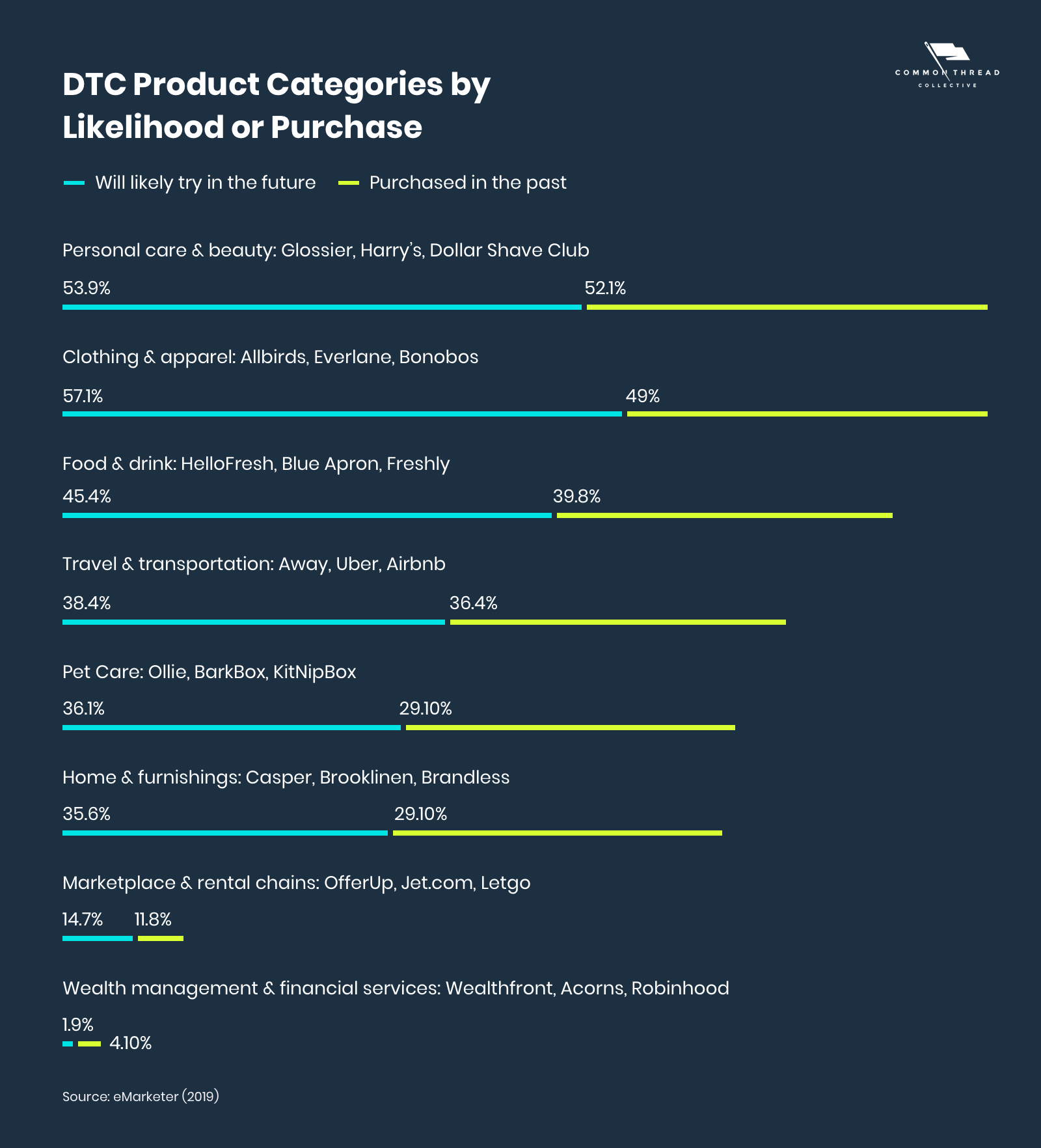

Every bit it stands, more half of US internet users have already purchased from DTC personal care and dazzler brands in the past:

Even more than promising, 53.9% said they will probable try new products from DTC'due south going forrad.

Cosmetic Manufacture Trends

The DTCs bring new creativity, while the legacies bring wisdom. There's a lesson to be learned from each …

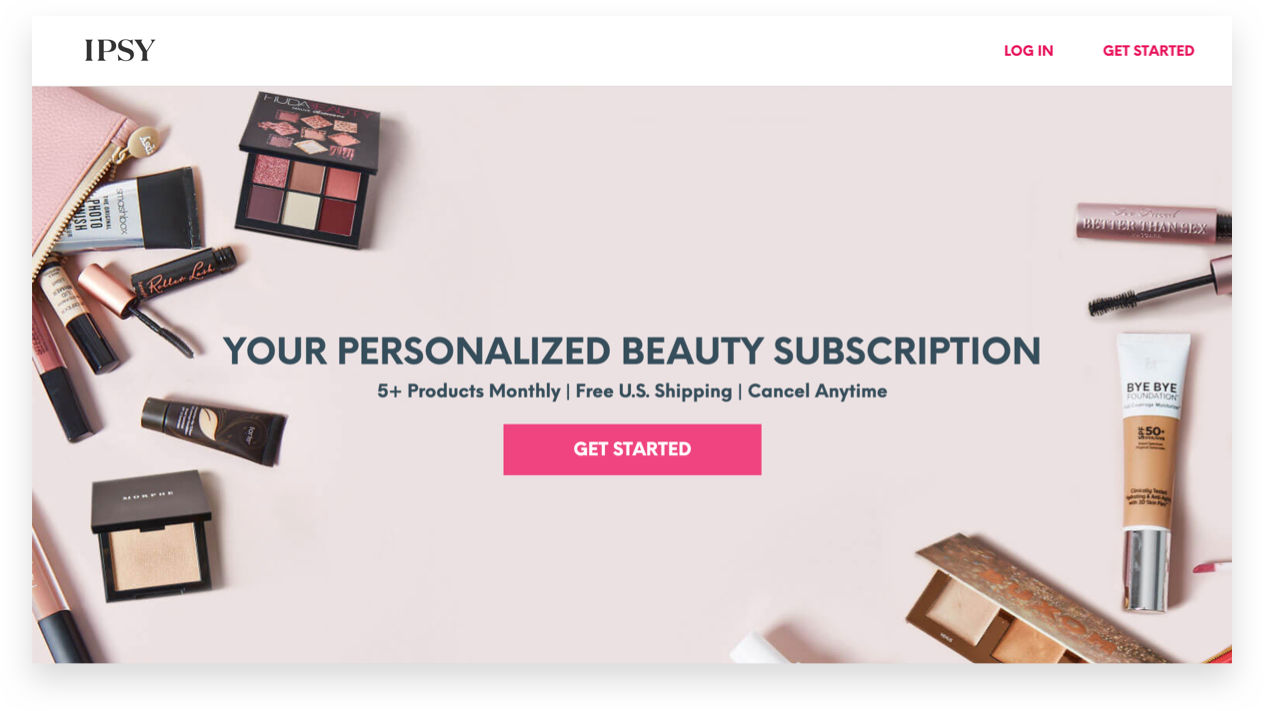

ane. Birchbox & Ipsy: Subscription Services

In the by several years, subscription startups similar Birchbox and Ipsy have reached valuations ranging from $500 one thousand thousand to $two billion — with investors encouraged past the belief that they'd grow apace because they had a recurring revenue stream.

Pioneers of the subscription economy, Birchbox and Ipsy solved for the problem of production discovery — calculation elements of delight and convenience.

Despite a strong first, by 2018 less than 10% of US net users had received a subscription box in the past calendar month (eMarketer).

It besides proved difficult to continue assisting, as many customers would sample products through their subscription boxes, simply ultimately buy the full-sized items from retail giants rather than the startup'south site.

Now, even Birchbox — the purveyor of the subscription model — has turned to a new tactic to meet customers where they're at. Enter, the "pop-upwards" …

ii. Glossier: Pop-Ups

As a DTC brand that rejects the traditional brick-and-mortar model, it follows that Glossier's entry into the retail space rejects the norm.

Feel-led and cult-followed, Glossier seasonally opens exclusive pop-up stores from Los Angeles to London. Simply, the store experience is anything simply typical.

With different themes in each space and experiential marketing activations — information technology's built hype that attracts droves of brand enthusiasts eager to attempt out the products in real-time.

By engaging with its fans in a face-to-face setting, Glossier is able to deepen relationships with customers across online interactions. Yet, it doesn't come with the financial obligations of following a chain-store model.

Instead, the pop-upward model allows them to reap the benefits of a physical presence to capture consumer demand without the existent estate costs.

Withal, brands looking to imitate its model should showtime exist cognizant of who their ain consumer is.

eMarketer reports that 38% of customers interested in checking out popular-upward stores are those who already store online every week compared to 28% who prefer brick-and-mortar shopping.

Thus, the appeal of pop-ups may work best to draw in the digitally inclined shopper, rather than the latter.

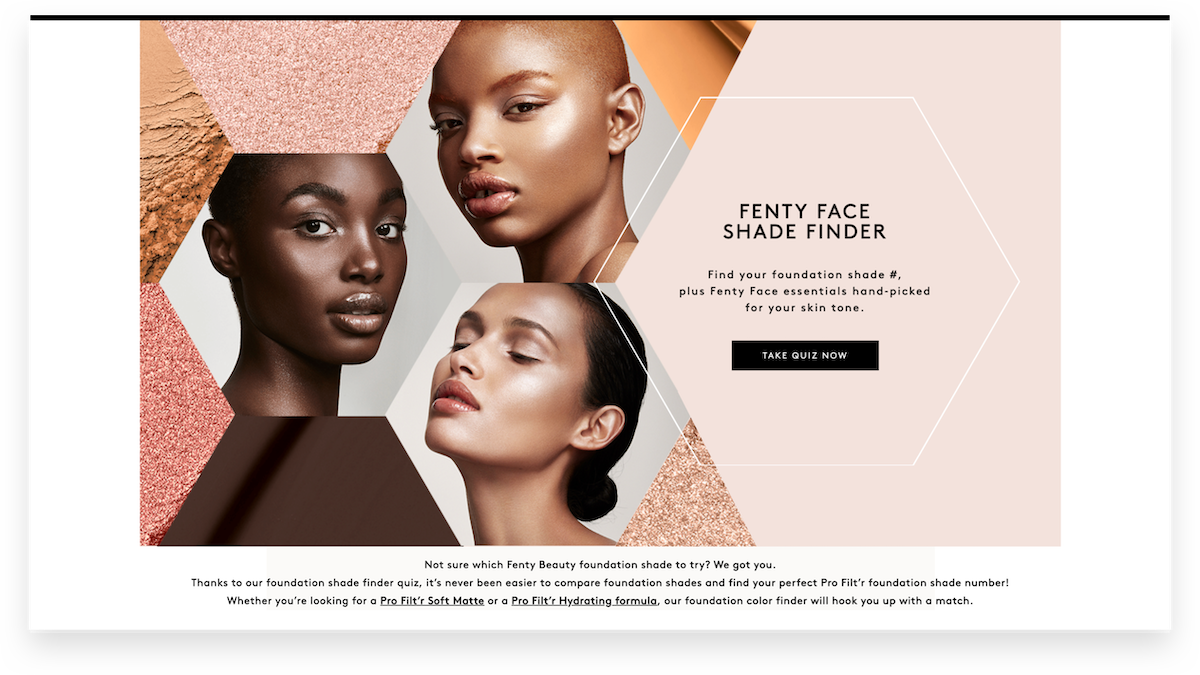

3. Fenty past Rihanna: Variety, Embraced

A product catalog that features foundation in a groundbreaking 40 shades. Marketing campaigns highlighting people of color. Authentic social media messaging.

Every piece of Fenty'due south business organization strategy is derived from a singular mission, "Beauty for all."

With a lack of multifariousness in the corrective manufacture, both in representation and production offerings, Fenty was proactive in creating for customers' needs, not reactive.

"I never could accept anticipated the emotional connection that women are having with the products and the brand as a whole," Rihanna told Time. "Some are finding their shade of foundation for the first fourth dimension, getting emotional at the counter. That's something I will never get over."

It reflects a sense that what used to exist considered niche past primitive advertisers is no longer. Rather, it'southward a wake-upwards call for marketers that diversity is critical to the expansion and service of all consumers.

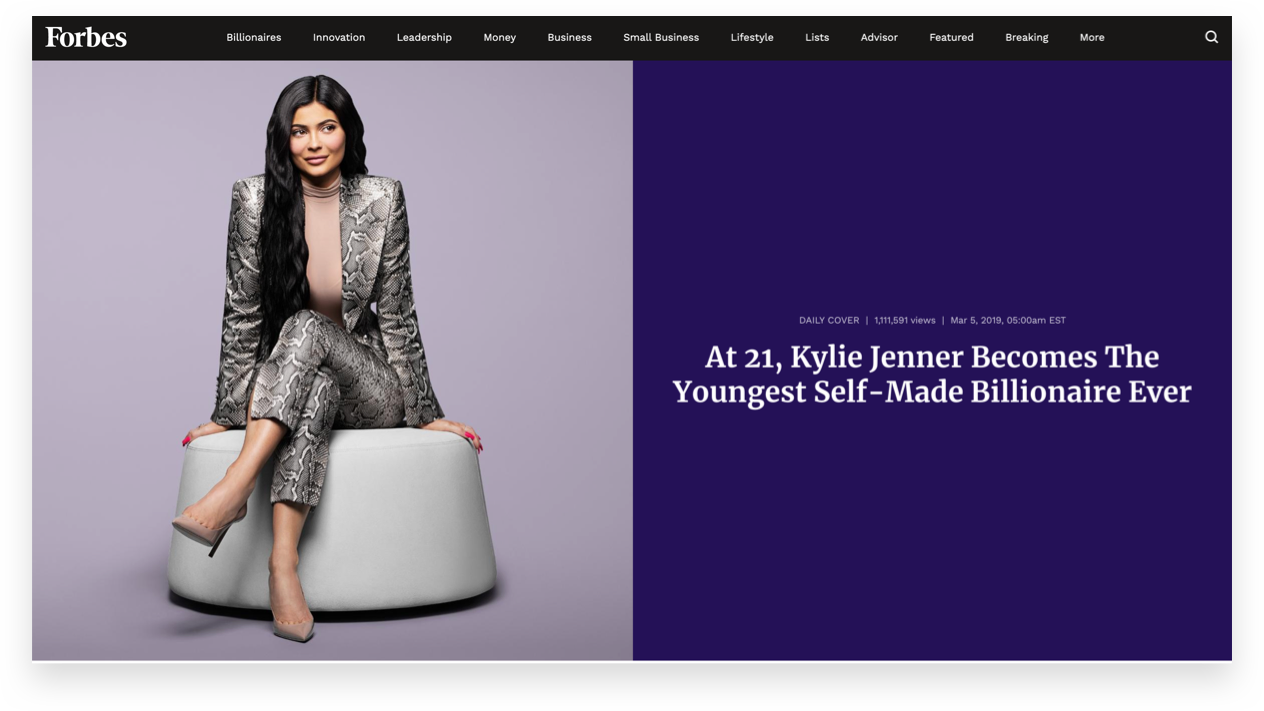

4. Kylie Cosmetics: Influence

Love her or detest her, Kylie Jenner rocketed from reality-Television receiver "bandage member" to full-fledge entrepreneur over the last five years.

Reaping the benefits of hundreds of millions followers on her personal social channels combined with the business accounts, her success is a testament to the power of influencers on social media.

"It's the power of social media," Jenner told Forbes. "I had such a strong reach before I was able to showtime anything."

Kylie was nurturing her social audience long earlier she e'er asked them for the sale. By posting YouTube videos of her makeup routines and sharing looks on her Snapchat stories, she had positioned herself as a leading voice.

So, when the Kylie line launched, the lip-kits sold out in less than a minute. Her followers didn't need whatever convincing. They were sold on the product because they were sold on her.

5. L'Oreal: Forwards, not Backwards

More a century old and a household name throughout its lifetime, L'Oreal is the leader in sales worldwide.

Keeping the atomic number 82 amidst decades of revolution has required that L'Oreal doesn't wait back and revel in its condition. Rather, they must constantly adapt the model to progress forward and keep upwardly with DTC disruptors.

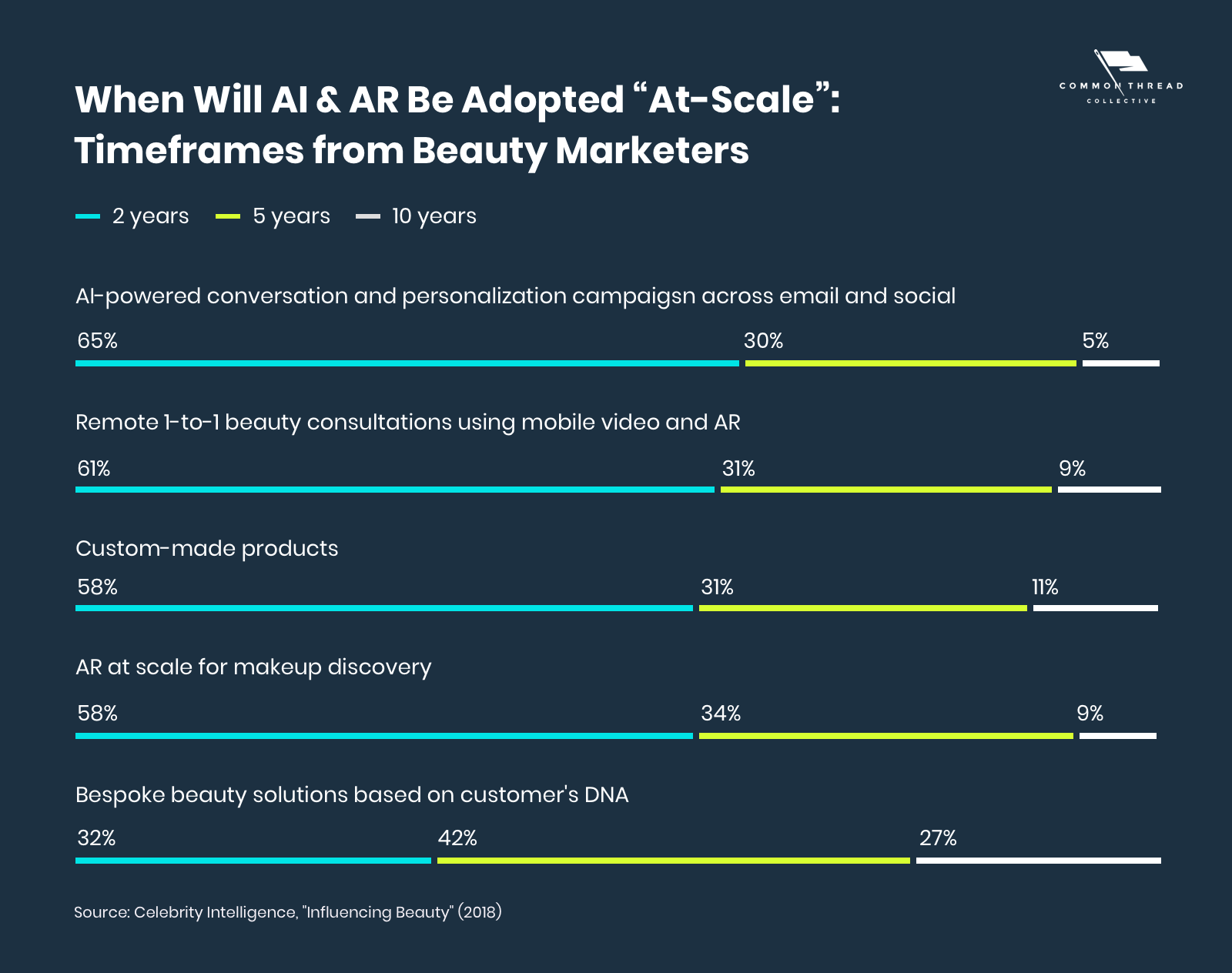

L'Oreal's strategy: get out of the old (legacy) by integrating the new (applied science). Its accent is on pioneering new technologies like AR, VR, and AI to bolster production discovery. They've even coined the shift to digital marketing strategies, "Marketing 3.0."

Marketers worldwide quickly followed L'Oreal's lead, with 65% expecting AI-powered conversation campaigns to be adopted at-scale by 2020.

"The game won't be the same when yous simply ask your voice banana to buy the all-time mascara for you. Or if you are able to sentry a makeup tutorial directly on your face with a virtual endeavor-on," said Lubomira Rochet, L'Oréal's global chief digital officer in a Call up with Google interview.

"The brands that master these experiences volition be the ones people cull."

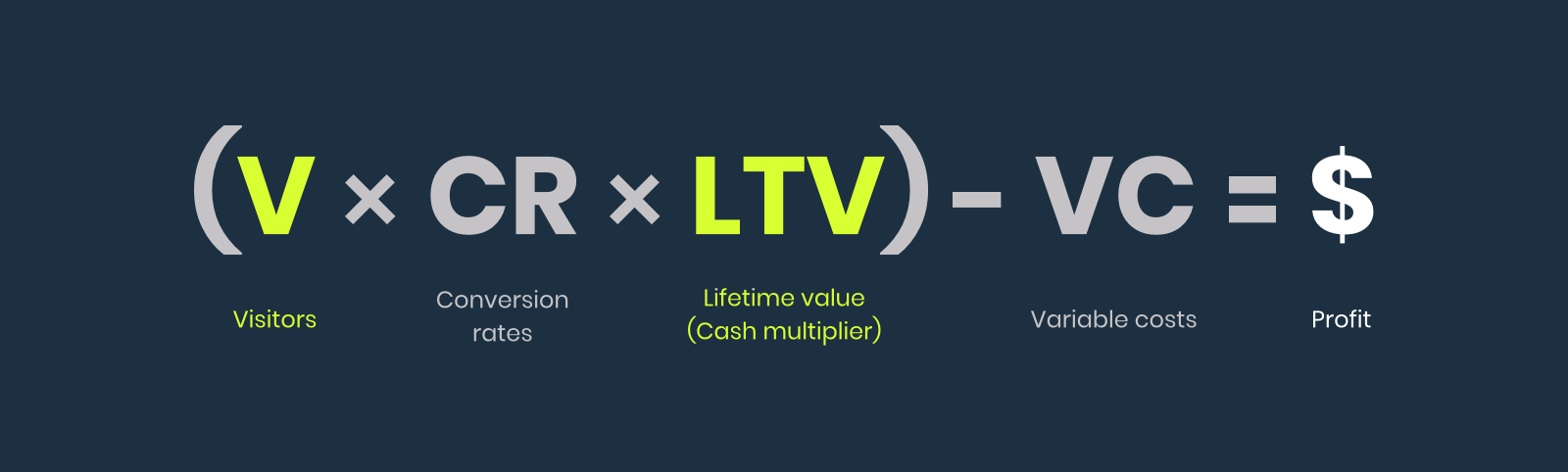

Strategies: Your Ecommerce Marketing Growth Plan 'Make Over'

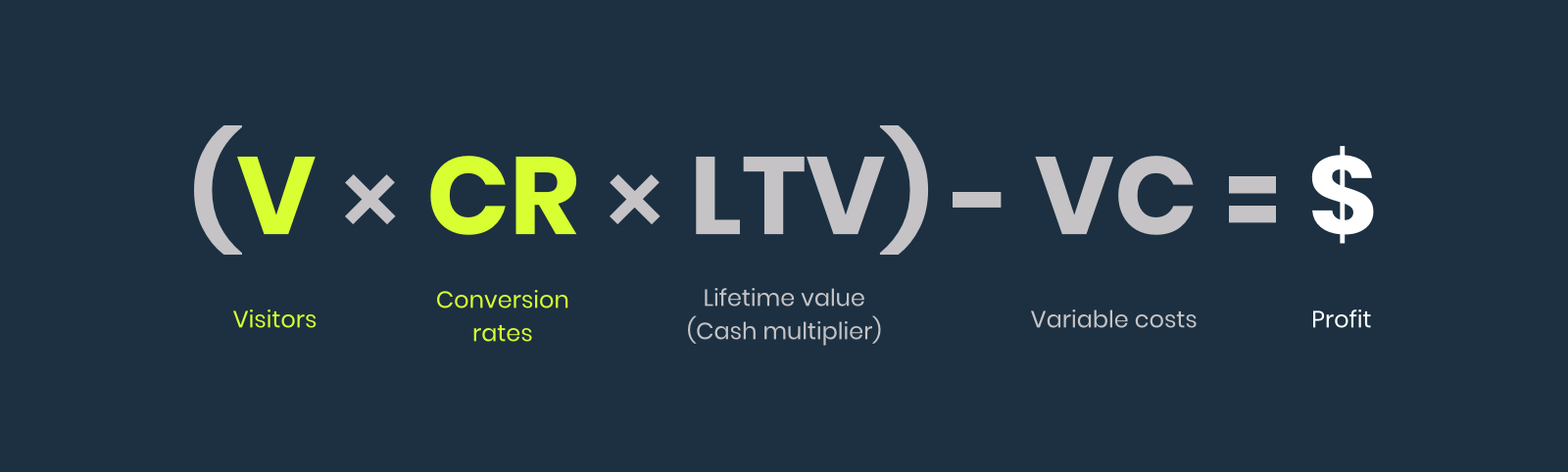

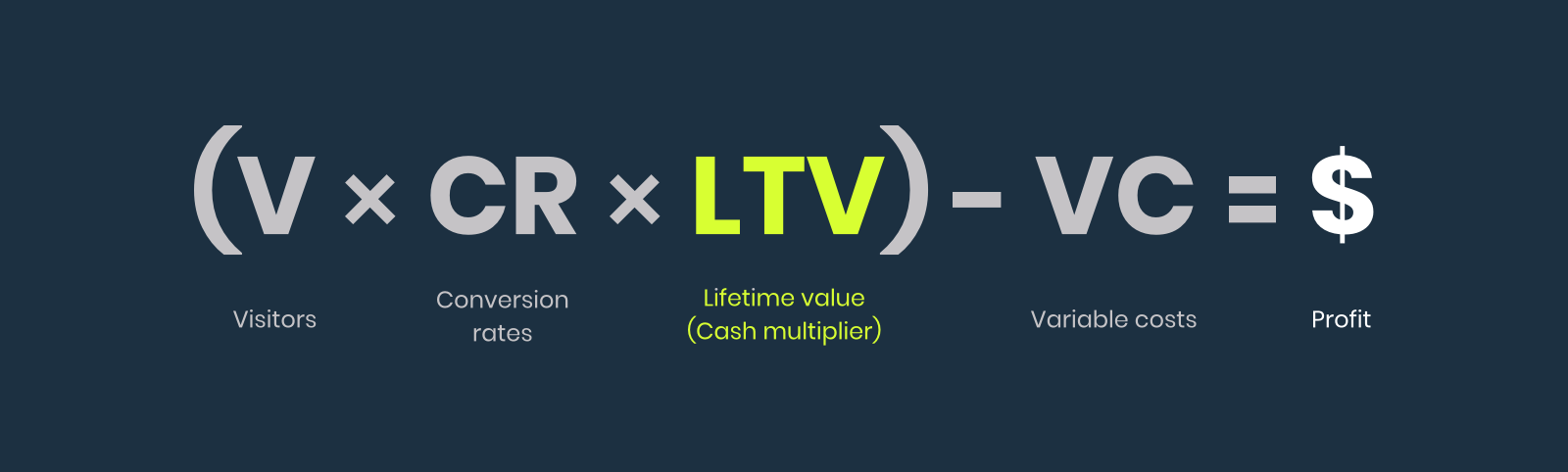

When growing a cosmetics brand from the footing up, only iv metrics thing: visitors, conversion rate, lifetime value, and variable costs.

We phone call information technology the …

There's no other way to increase your profitability than to bear upon one of these iv variables — driving them forward through a strategy built for growth.

Visitors: Driving Traffic

Drive new and returning customers (your target audience) to your online store beyond every distribution channel available.

Social Media Advertising

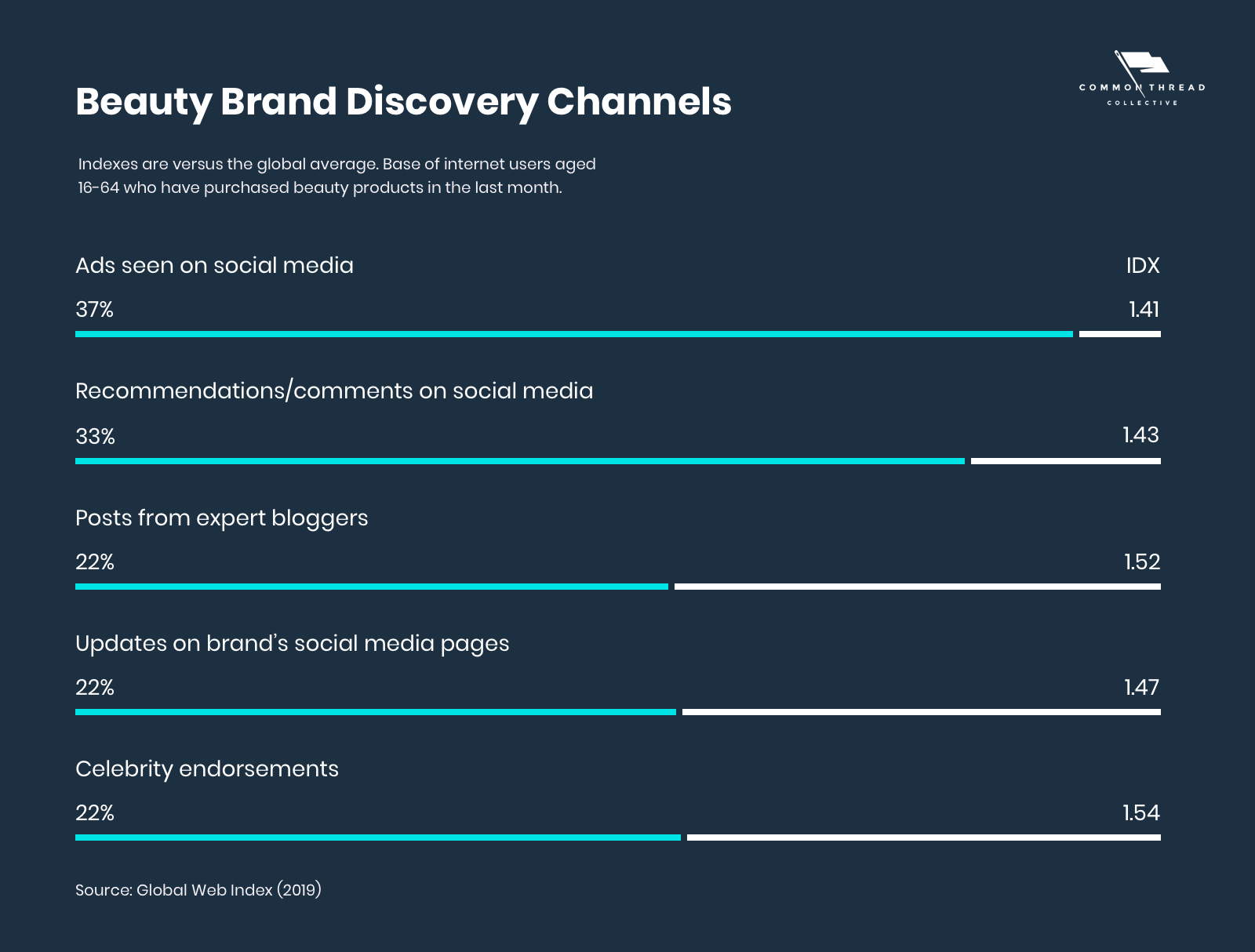

Glossier named it the main reason for its success. Rihanna exclusively launched her brand on it. Social media marketing across Instagram, Facebook, and Twitter is the honey pot for mod beauty brands.

The numbers follow the tendency:

Begin past determining what makes your product visually intriguing. So, examination that out in your ad creatives.

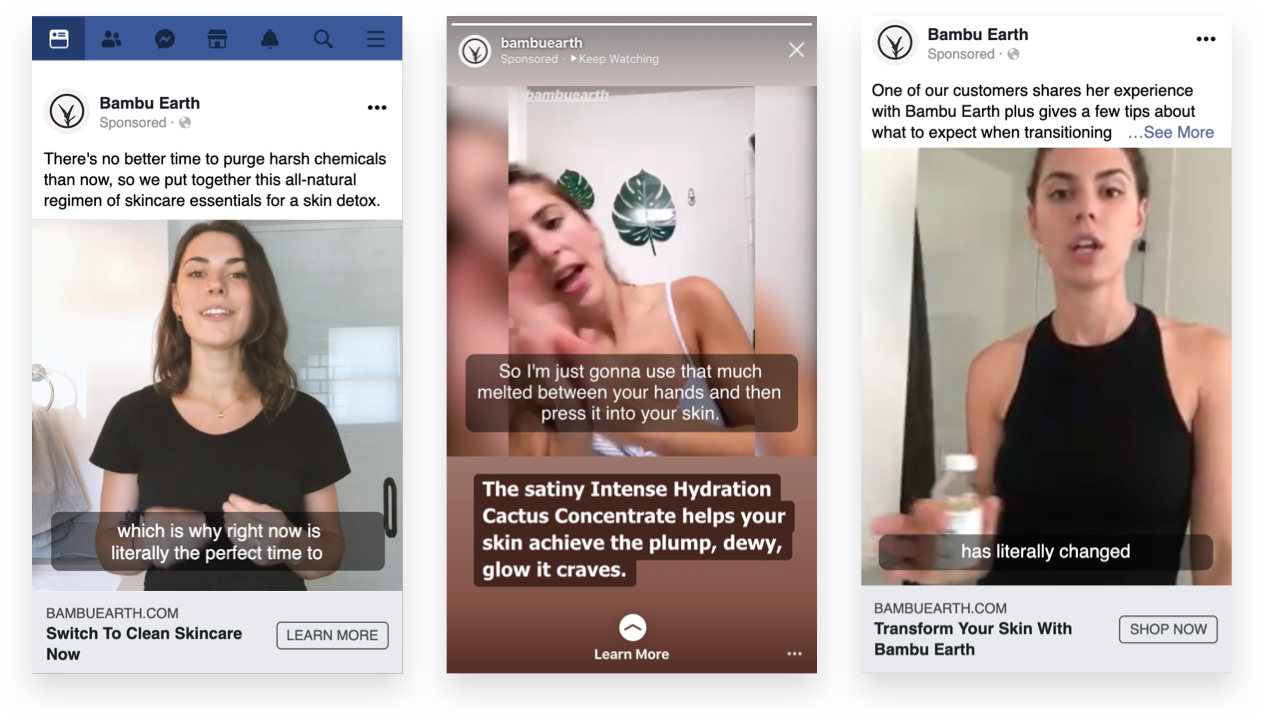

"When selling a production similar a moisturizer, showing an awarding photo isn't that interesting," says Vincent Wu of Bambu Earth.

"Instead, nosotros started shooting photos of the jar angled onto the top of the production. We messed with the production textures, lighting, props — and have establish advertizing success with it because of the unique artistic display."

After using the right side of your brain, don't forget about the left — develop a social media buying strategy. Get-go by calculating your numbers past examining customer cohorts:

- What are people doing post-buy?

- Are they coming back?

- If then, how many and how long does information technology take?

Then, utilize this data to come upward with a spend strategy that aligns with your cash period and goals.

Influencers

The advantage corrective brands have compared to other industries, is that influencers can showcase results in existent-time.

What used to exist walking through malls with associates applying makeup samples for costless, is at present replaced past bloggers doing alive social media tutorials that demonstrate the results and what they like about it.

Information technology's easy to fake affinity for the product or brand through a even so image or written copy. Past having the influencers create video content — the authenticity, or lack thereof, will be clearly seen.

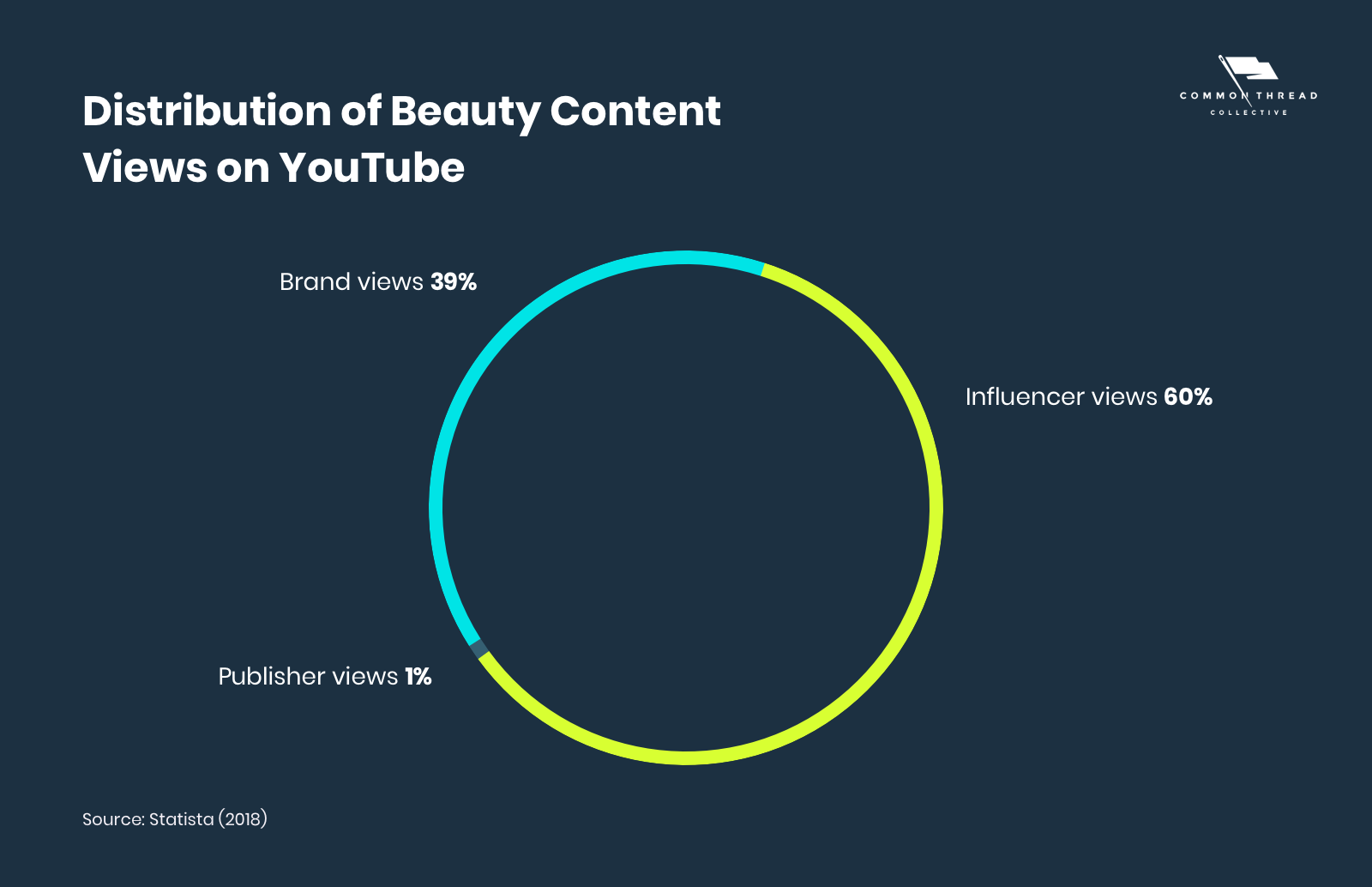

The numbers back it up. With a majority of beauty content consumed coming directly from influencers instead of brands, it's indicative that edifice trust through social-proof can touch on buying behavior.

"Create TikTok and YouTube tutorials that evidence usage and results," says Cody Wittick of Kynship, an influencer marketing agency. "Include testimonials, such as 'this product made me feel [blank]' or 'I loved this well-nigh information technology.'"

"Unboxing videos often gets overlooked," says Wittick. "Fabfitfun created a stir about this, nevertheless it'south a tactic that nonetheless gets neglected."

Create a great first impression with the influencer by sending something special to them. If yous don't take the budget, write a handwritten note. Personalizing the experience will increase affinity and the resulting content will reverberate that genuineness.

Search Engine Marketing (SEM)

Google Shopping for ecommerce always was and will continue to exist the virtually important campaign blazon yous can leverage.

Inside Google Shopping, the biggest focus must be information feed management.

Every bit opposed to normal search campaigns, Google Shopping campaigns do not use specific keyword targeting. Instead, ads are targeted using the information in your customer feed. Google has a long list of specifications that explains which information they need and in which format they demand it in.

While there's plenty of data you tin can send Google in a feed, not all fields are created equal. Certain optimizations will accept more than of an impact than others, with product title being the almost important.

"We like to become as much information into the production title as possible within the 150 character limit," said Common Thread Collective'due south Director of Paid Search, Tony Chopp. "And typically we similar to follow some sort of structure to continue things consistent, for instance:

- Brand + Product Blazon + Color + Fabric

- Brand + Size (length, width, pinnacle) + Product Blazon + Color

- Fabric + Product Type + Colour + Make

- Style + Colour + Production Type + Make

- Product Type + Size + Color + Feature + Brand

Think nigh how you lot can get potential not-brand search keywords into your products. And mind the social club. Google places more weight on words at the beginning of the title than those towards the end.

Search Engine Optimization (SEO)

When combining organic with paid marketing campaigns, the potential for growth skyrockets. Still, revere owned media channels to generate returning customer value, not as your source of new client acquisition.

Build personalized email flows. Create useful web log content. Cherish your organic audience and advantage them for continually choosing to engage with y'all.

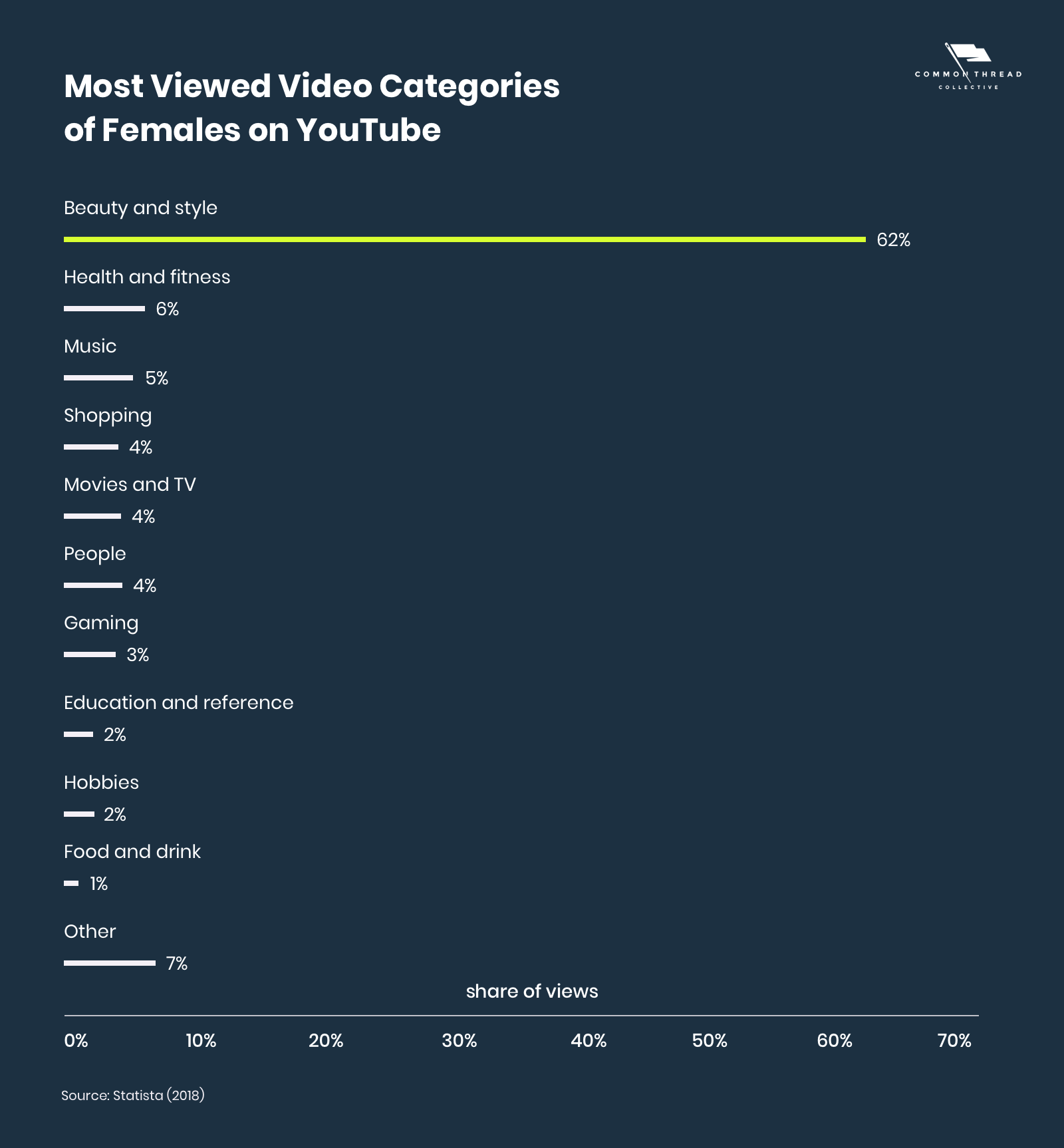

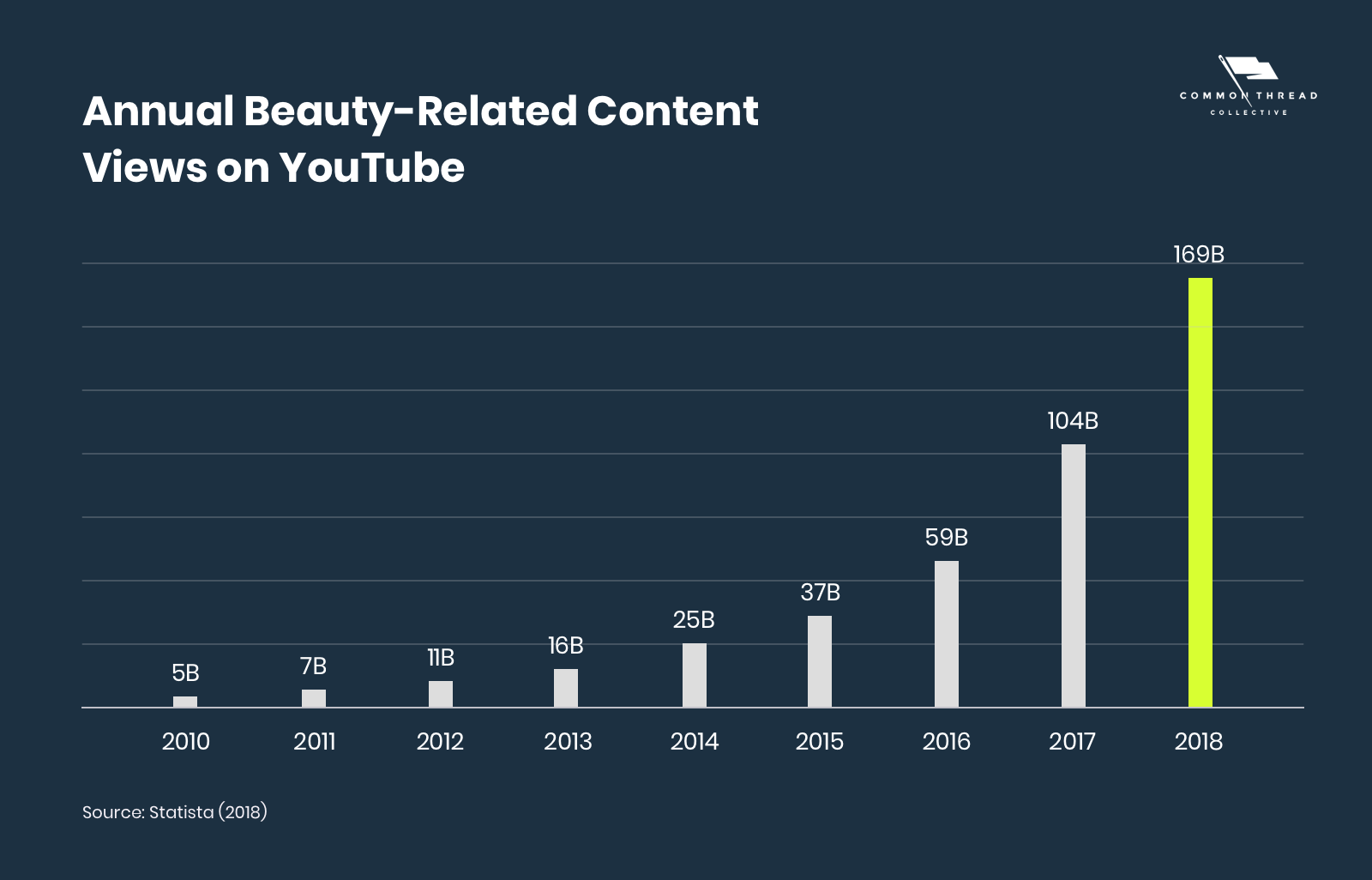

YouTube

The leading content category among women and a fanbase of millions – dazzler has taken YouTube by storm.

From skincare tutorials to shopping "hauls," the platform is ripe for both entertaining and convincing new buyers.

The best part? Legacy brands aren't dominating.

Their content makes up 3% of total views, while private "vloggers" control a stunning 97% (DigitalSurgeons).

Startups looking to capitalize on the massive infinite must use the power of influencer marketing.

1 of the nigh famous faces on both YouTube and in the manufacture is Jeffree Star. The vlogger has built such a frenzy around his personal brand, that following the launch of his own brand-up collection, the hosting Shopify site went downwardly within minutes of outset due to extremely high shopping volumes.

You guys CRASHED the site! Shane'southward in a ball crying on the floor. Working on getting everything support!!! #shanedawsonxjeffreestar

— Jeffree Star (@JeffreeStar) November 1, 2019

The recipe for his content success: immersive tutorials that build excitement around a product to ultimately sell and brand money. Star even managed to make the listing of the highest-earning YouTube stars in 2019 across all content categories, with estimated annual earnings of xviii million Us dollars.

His influence, amid other YouTube stars, is a testament to the mode that consumer buying behavior is changing significantly and probable for the foreseeable future.

As a result, YouTube campaigns offer affordable awareness and assisting conversions.

Notwithstanding, it's worth because how you mensurate the success of your YouTube campaigns. Typical attribution setups in Google Ads practice not direct report on view-through conversions, only you lot can analyze them by looking at the "All Conversion" reporting columns.

"Nosotros frequently mensurate YouTube (and Display) differently than traditional search and shopping campaigns, by at least considering a i-day view through window," recommends Chopp.

Conversion Charge per unit

Acquire new customers and increase AOV by optimizing your onsite experience.

From driving visitors through ads to the pattern experience, conversion rate encompasses the culmination of digital marketing efforts within your sales funnels to finalize a purchase.

Tactics to increase conversion rate include electronic mail capture, reviews, trust seals, user-generated content, subscriptions, and in-cart or post-purchase upsells. This combined with site speed and mobile optimization allows for a seamless shopping feel.

Client Lifetime Value

To build your business organization over the long term, the most important and often overlooked metric is your customer lifetime value (LTV) or "greenbacks multiplier" (CM). Rather than thinking about your entire lifetime of your business, nosotros desire to know what your customer is worth in a very specific payback flow.

Showtime by determining your 30-, sixty-, or xc-twenty-four hours LTV. And so, execute a plan that fits your greenbacks flow and builds your concern over the long term. Tactics like memorable unboxing experiences or content marketing can generate an organic community of brand evangelists.

Email Marketing

Retention, memory, retention.

Electronic mail marketing is critical to improving your LTV and maximizing revenue.

The good news is, nosotros've already laid out the strategy to drive visitors to your site. Use their arrival to your advantage by encouraging subscriptions to your email lists, which will drive purchases further down the line if they don't catechumen the offset time around.

Whether your email subscriber is a future or past purchaser, mix two parts teaching and engagement with one role sales.

Drivers like loyalty or subscription programs are tactics that build a community around your brand and lead to upsells further down the line.

From welcome flows to post-purchase flows, ensure your messages speak to your brand and provide value to your consumer's stage in the customer journey.

Variable Costs

If costs increment as orders rising, that's a variable cost (VC).

Opposed to fixed costs — similar rent and operational overhead — VCs cover COGS, platform and payment processors, supply chain, fulfillment, and client acquisition costs (CAC): total spend including agency fees.

Calculating costs revolves around a methodology known every bit unit economics: breaking down your inputs and outputs down on a "per unit footing."

To measure and optimize variable costs, follow a four-quarter accounting matrix. Each represents a portion of your acquirement that signals the health of that component equally well as areas of opportunity.

Instance Studies: Growth Lessons from 3 Cosmetics Brands

ColourPop

The Brand

ColourPop was founded in 2014 by siblings Laura and John Nelson. From there, the business grew organically, beloved for its affordable and colorful products.

With strong traffic and conversions coming from its limited-edition collaborations, the digitally native make was content in keeping the organic momentum going.

Until, organic wasn't enough.

The Challenge

Bachelor exclusively online and in Ulta, its focus was on catching customer's attention on social media instead of shelves. But, for a brand that was born organically on social media, it hadn't paid whatever attention to paid social media efforts.

Neglecting this category in its business strategy, meant missing out on new visitors and higher returns since information technology lacked in-shop discoverability. In order to abound and scale digitally, paid ads were the necessary next-step in its maturity.

The Strategy

Boost visitors. Increment returns. Build ROAS.

To do so meant amplifying ColourPop's bulletin to new prospecting customers past running conversion objective campaigns on Facebook.

A focus on conversions rather than awareness was strategic — the creative showed why the product was valuable, while the ownership methodology to get that creative in forepart of an audition encouraged customers to have activity on site.

The product was self-explanatory. Finding a style to show that it was all the same high-quality relative to the lower price point, was the creative unlock for the brand.

One messaging angle involved running ads about duped colors to its competitor audiences, who were selling similar products at higher markups.

"The biggest contributor to success lay in our power to make ColourPop stand out in a competitive market, without blatantly calling out the price of the product on the ad level," said Growth Guide, Michelle Luo.

"Instead, we opted to testify the product in use, so that you lot tin really see the quality and color payoff of the products."

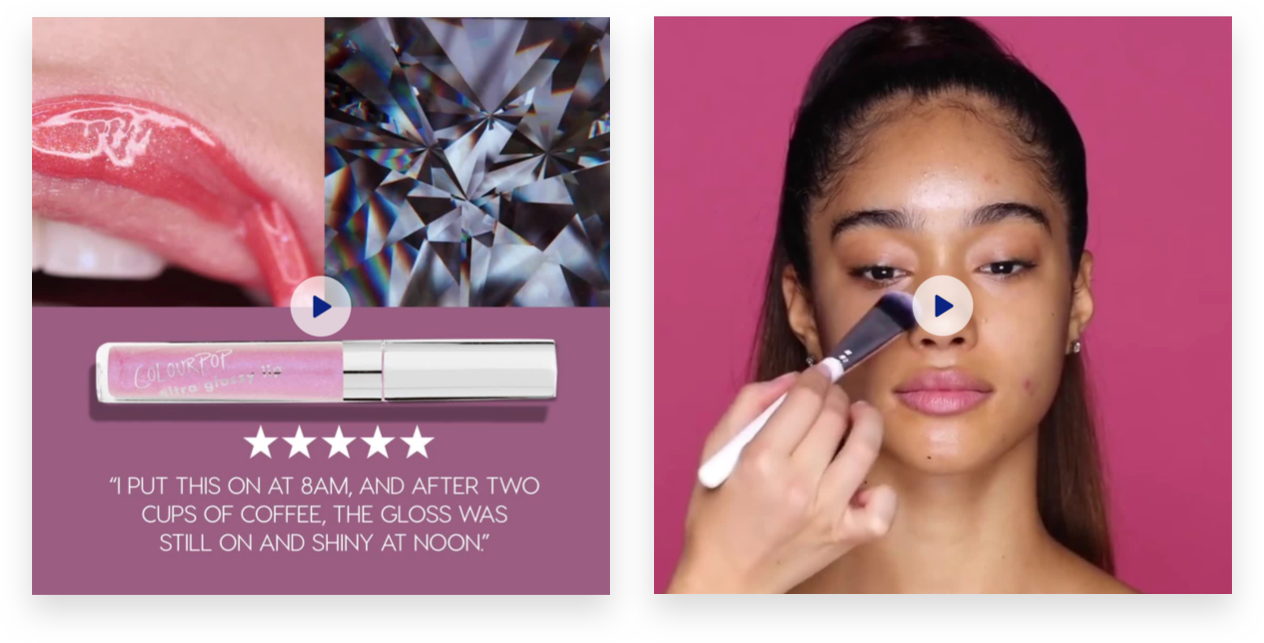

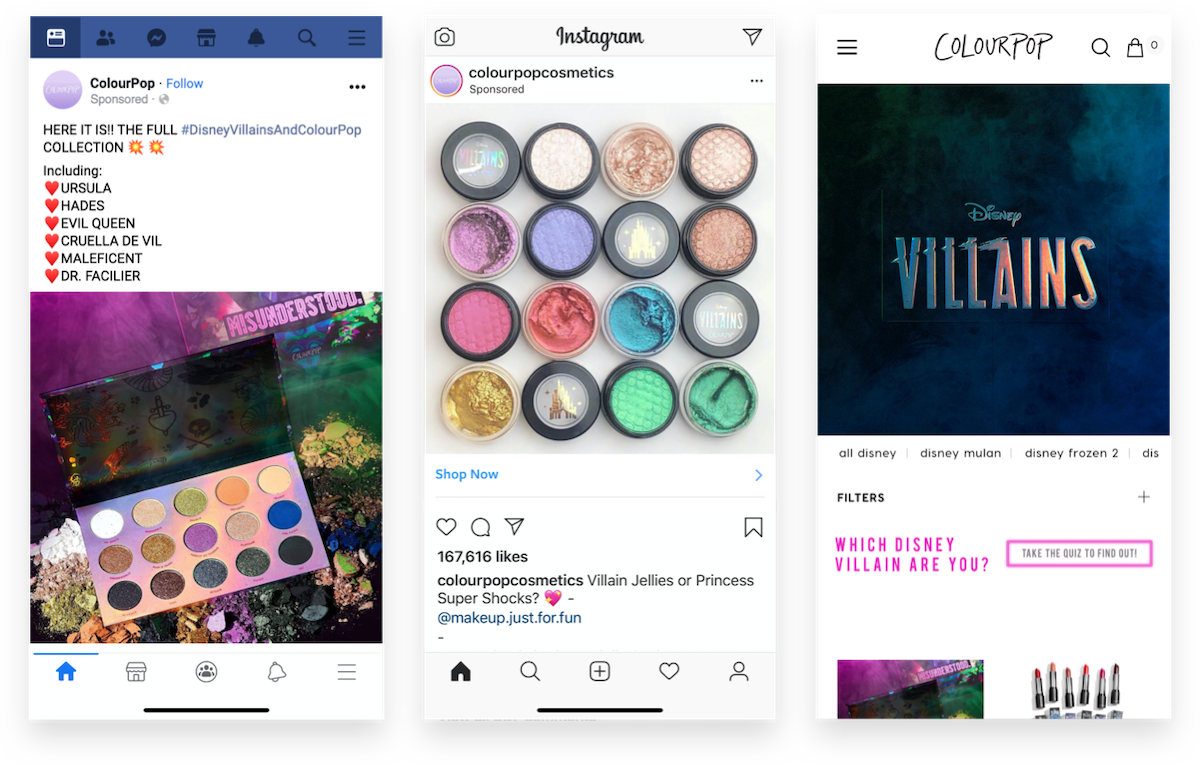

After toll, the major wins were ads that highlighted production quality. Whether it was upwardly-close videos of putting lipstick on and not seeing it cleft or user-generated content – the advertising focused on the color payoff and how good the product looked.

"It didn't matter if the ad was pretty," said Luo. "It mattered that it showed real people using the production."

A website optimized for conversion rate completed the holy grail. By capitalizing on its audience with new creative and running conversion campaigns to get them onsite, it was the perfect trifecta to ensure purchases.

This culminated with ColourPop'south collaboration with Disney. Each princess launched her own makeup collection featuring limited edition products.

Thumb-stopping creative run to a Disney audience, the advertising campaign smashed, with a 15x render on i-day-view, one-day-click.

It was and so successful that information technology capitalized by following up with a Disney Villains make-up line, reaping in wicked returns once again.

The Results

- 5x return on prospecting campaigns

- vii.5x return on remarketing efforts

- 15x return on Disney campaigns

Bambu Globe

The Brand

Bambu Globe is a clean-beauty make that takes a holistic approach to skincare using all-natural products to restore peel to its natural land.

Amber Hawthorne founded the business organisation over x years ago, and in early on 2019 was caused by 4x400 — Common Thread Commonage's (CTC) in-house property company that acquires and builds digitally native brands.

A win for everybody involved … until it wasn't.

The Claiming

For the first few months, Bambu Earth struggled.

It was all the things you expect … low traffic and dismal conversion rate that no new creative or better-performing advert could fix.

And the reason was simple: they just weren't converting enough customers (a two.xiv% conversion rate at a $64 AOV just won't cut it), which meant they couldn't afford to drive more traffic.

Offset, Bambu Globe needed a brand refresh, both visually and conceptually. And then we rebuilt the website and antiseptic the brand pillars that were true to the core of Amber'south long-held commitments to her customers.

From at that place, it needed new advertising that reflected that. Some new UGC and reshot production-focused imagery started to fuel real growth.

"All of a sudden it was on the cusp of rocketship growth," says Andrew Faris, CEO of 4x400 "and nosotros could feel information technology. We just needed that ane big push to really get united states over the edge."

At a starting time-upward phase in its business concern, increasing every lever for growth ultimately matters for Bambu Earth. Yet, while it's always iterating on driving and converting traffic that will affect AOV — because information technology's a consumable product, lifetime client value is the game.

The team knew that customers who converted stuck around. So they had to practice two things: solve the conversion rate consequence, then validate the LTV assumption.

The Strategy

"LTV is the thing that has and volition continue to turn Bambu World into a huge role player," says Faris. "At its core, we believe that's possible because the product is so strong."

Knowing its products' strengths sets upwards the brand strategy to focus on increased spending of marketing dollars relative to its summit-line acquirement (and experience actually good about the outcome).

It all starts with tracking LTV by first-product-purchased.

"If you don't know what you're trying to track, you lot will never get good," says Faris. "I remember this is a really underestimated step, is that you can't actually practise a great chore strategically without having the information on hand from the start."

For instance, if LTV on a moisturizer is strong, all the same costs the brand a significant amount to acquire that customer in the first place — being a startup, Bambu Earth can't front end the cash flow over the long term for it to be worth it to the business organization.

On the other hand, if the LTV is not as strong on the toner, but Bambu tin acquire that client actually cheaply — at that place's profit to be fabricated before.

While LTV is the main variable at play, the lesson is that yous take to practise that relative to the price of acquiring the customer in the first place. This prep work isn't complete without factoring in the margin to decide where the cost value is.

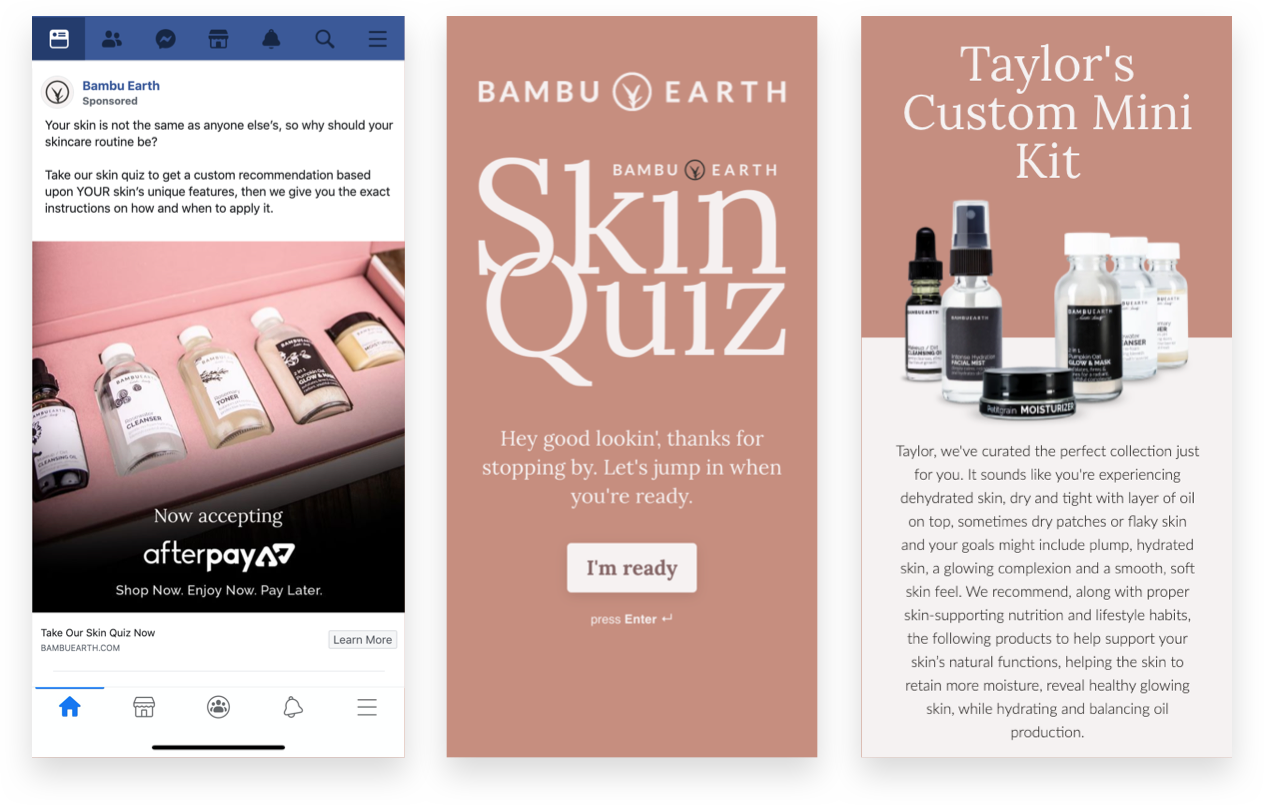

Within that, a singular strategy emerged to solve for LTV: a skin quiz.

When visitors arrive, they're kicked into a quiz on the homepage with questions near their skin health, lifestyle, and goals. After finishing the quiz, customers are and then given a custom product recommendation based on their results.

Memory first and foremost is most having a groovy production that really works for people.

"We desire to make sure that we set people up for success," says Faris. "We use the skin quiz as a fashion to serve our customers well by giving them a production they'll love, which creates value for the states because they want to proceed coming dorsum."

Building on LTV doesn't stop there. It means hammering abroad at every element:

- The quiz itself

- The landing page

- The ads that drive visitors

- The mail-purchase electronic mail flow

The team has personalized things fifty-fifty further. Beginning, by adding customer service options relative to where visitors land. 2d, by tracking what questions people inquire about each kit and then putting those answers on each product page

Ultimately, it'southward about developing a full-funnel arroyo to acquisition and retentiveness … as opposed to simply an ad strategy. It allows Bambu Earth to (at-scale) walk people into the best product for them and and then sets the make up to address that.

The Results

- 25x revenue YoY (and is now a profitable business organization).

- Customers who buy through the quiz 2x value inside xc days and 2.5x AOV within 90 days.

- For the month of February 2020, Bambu Globe had earned as much revenue from returning customers only equally it did in total client revenue overall for 2018.

Coola

The Make

The Coola brand is the quintessential piece of California life and its products embody that ethos — from organic wellness to an outdoor, active lifestyle. Its skincare products are eco-conscious and sourced with a "farm to face" philosophy.

CTC caught Coola'due south drift and fix out to achieve its goal of protecting and improving peel, utilizing paid media to increase purchases of its organic sun-care products.

The Challenge

Getting customers to your site doesn't e'er come inexpensive. With CPMs for paid traffic higher than most, the difficulty is increasing visitors without breaking the banking concern.

Coola was no exception. Equally a brand that wasn't digitally native, the hurdle was gaining traffic online, not simply in-stores. With a significantly high conversion rate, the opportunity was there.

The goal became getting qualified traffic to the site for a lower cost.

Alongside the obstacle of increasing visitors, was increasing AOV and LTV.

Before launching its paid media entrada, the CTC growth team conducted assay and plant that certain Coola products had higher AOV on Facebook (people would tend to bundle them with other products) at the top of the funnel.

Equally customers went down the funnel, they'd tend to purchase more.

To capitalize on this meant finding ways to increase repeat purchase charge per unit and the lifetime value of the customers that it was actually driving.

The Strategy

To gainsay high CPMs, it all came down to the creative strategy behind its social-media advertizement.

For example, 1 of the top products for Coola is its "Sunless Tan" — but the claiming became adjusting the advertising messaging angle during each season to produce creative that converts yr-round.

In the wintertime, the focus was on keeping a bronze glow all year. In the summer, the messaging was most accentuating your current tan with the production.

To increase visitors, the team tested different creative variations for advertising — from notwithstanding images to long-form makeup tutorials on YouTube. Through artistic testing, they found a balance.

From a prospecting standpoint, long-form YouTube videos that showed people applying the production and illustrating its core benefits resulted in enticing content with a native-feel that led to engagement.

Then in remarketing, the squad focused more on the bodily production itself, with gifs and nevertheless-image product photography to further inform the consumer.

After identifying winning creative combinations by marketing campaign stage, the team then began hyper-targeting audiences. This strategy went against the grain of CTC's typical buying methodology of targeting broad audiences, but it was because of ane of import caveat …

The Coola product catalog is diverse, from lip balm and sunscreen to aging serums and BB creams.

"Instead of our normal broad prospecting and remarketing, we congenital specific funnels around key products that demonstrated high AOV," said Growth Strategist, Andy Reese.

"Whether it was the sunless tan collection or the aging serum — each diverse product had its own funnel from top-to-bottom, and so we could hyper-target those interested."

By selling through private production funnels, Coola offered customers the niche products they actually needed — making them more than likely to convert — instead of putting them into a standard remarketing audience where they're getting ads for products they didn't bear witness interest in.

This became a layup for improving lifetime client value. "We know that the furnish charge per unit for the sunless tanner production is lx days," says Reese. "Then anywhere from 45-60 days after they've purchased, to affect LTV, nosotros'd target them with an ad to remind them to re-up on their product purchased."

Running contempo-purchaser campaigns by product funnel increased Coola's repeat purchase rate by over fifty%

It wasn't just ecommerce that was reaping the benefits. Coola saw the results of Facebook advertizing come through on other channels.

After running paid ads, there was a surge in in-store purchases of Coola products within retail locations at Ulta and Sephora. Digital strategy positively impacted the business holistically.

The Results

- 140% YoY growth

- +50% elevator in repeat customers

The Right Partner: Practice You Need a Cosmetics Marketing Agency?

After growing brands like ColourPop, Coola, Bambu Earth, and more … we pride ourselves on being experts in every stage of the online sales procedure.

From creative content to media buying, our solutions are specifically tailored to tweak the variables that create revenue.

Terminal, don't forget to take hold of all the information, tactics, and case studies in one fittingly beautiful PDF:

Reilly Roberts is the Marketing Specialist of Common Thread Commonage. If y'all'd like to connect with her nigh all things copywriting — or even better, her favorite bands — reach out via Twitter or LinkedIn.

0 Response to "Fashion Fresh Cleaners - Crossroads Shopping Center, Vineyards, Fl"

Post a Comment